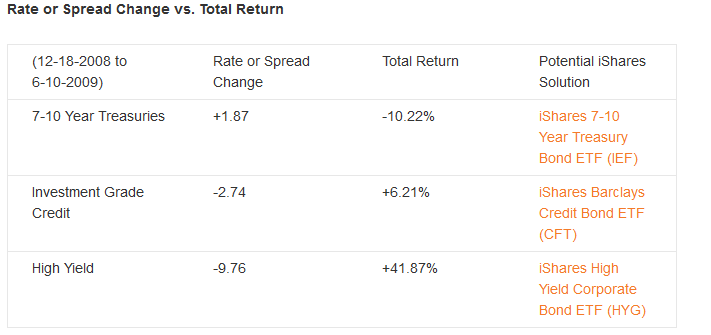

For example, during the last period of rising rates from December 2008 through June 2009, yields on 10-year US Treasuries increased from 2.08% to 3.95%. Rates were increasing as investors were moving from safer assets into riskier ones as the economy recovered from the financial market dislocations of Q4. Credit spreads also tightened with investment grade spreads declining from 5.89% to 3.15%, and high yield spreads declining from 18.95% to 9.19%.

Source: Blackrock, Bloomberg and Barclays as of 4-11-2013. 7-10 Year Treasuries return represented by the Barclays 7-10 Year Treasury Index. Investment grade credit represented by the Barclays US Corporate Bond Index. High Yield represented by the Barclays US High Yield Corporate Bond Index.

As a result of these increases in US Treasury yields, returns on 7-10 year US Treasuries fell by 10.2%. With credit spreads declining on investment grade credit and high yield, both sectors had positive total returns of 6.21% and 41.8%, respectively. While this situation was extreme in terms of the magnitude of credit spread tightening, especially in high yield, it illustrates the often-observed rise in the risk-free rate accompanied by tightening credit spreads.

Another sector to rotate into might be even higher risk asset classes that would also benefit from spread tightening, such as emerging market debt (such as the iShares Emerging Markets Bond ETF, or EMB). Layering in ETFs in these asset classes can help offset price losses from rising risk-free interest rates as more of their yield comes from the credit spread. However, be aware that you are trading off interest rate risk for credit risk within a portfolio by employing these strategies. A deterioration in the economy and the credit market could adversely impact such a portfolio.

Hopefully this has post has provided more clarity on how to think about asset allocation in a rising interest rate environment. In my next post, I will illustrate how to use ETFs to reduce interest rate risk when rates increase.

Matt Tucker, CFA, is the iShares Head of Fixed Income Strategy.