The Rise of Gold ETPs

While gold miners have historically traded at a premium to other equity sectors, their P/E ratios have fallen below those of the S&P500 and of the base metal miners. Based on historical P/E ratios2, gold miners are now trading 70% below their 10-year average and 48% below their 5-year average. While the average P/E ratio of the companies constituting the S&P500 and the material sector within the S&P500 dropped by 26% and 40% respectively over the past 10 years, gold miners’ multiple fell by over 70% over the same period (Figure 1).

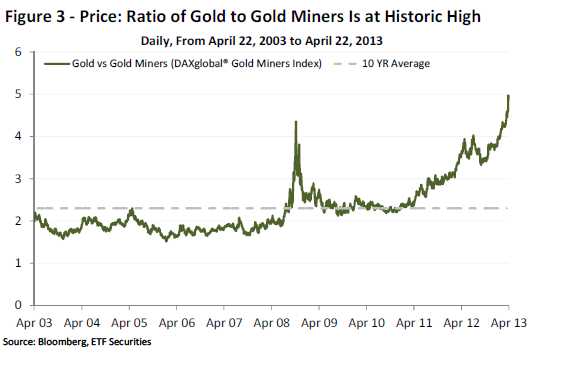

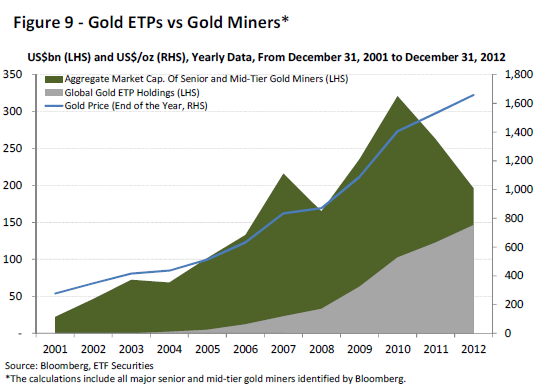

This trend is unlikely to continue, given the changes that the industry as a whole is undertaking. Although the recent changes in management and strategy will take time to produce a material impact on the industry, with average P/Es now below the mining sector average, current valuations may set a floor to any further de-rating. While poor management, skyrocketing costs and lack of new mine production probably had an impact on the drop in gold miners’ P/E values, the introduction of gold ETPs may also have played a role by giving investors alternative access to the gold price performance. Since the introduction of the world first physically-backed gold exchange-traded product in 2003 by ETF Securities, the gold market has undergone radical changes. Prior to the advent of gold ETPs, many investors interested in gaining exposure to gold had to rely on gold mining stocks. Gold ETPs have made it easier for investors to gain direct exposure to the gold price, removing the need to own gold miners in order to get exposure to gold price moves. From its peak in 2010, the gold mining sector has lost approximately US$125bn in market capitalization; over the same period gold ETP holdings have increased by US$45bn (Figure 9). The two are not necessarily directly linked, but anecdotal evidence indicates that some investors have chosen to get their gold exposure through ETPs rather than through gold miners.

The Benefits of Investing in Gold Miners

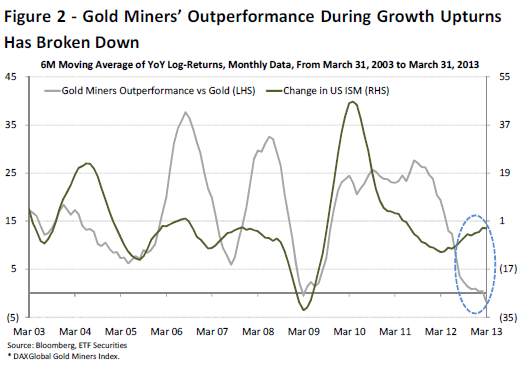

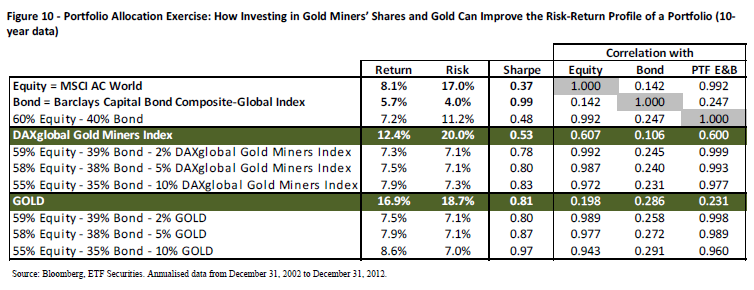

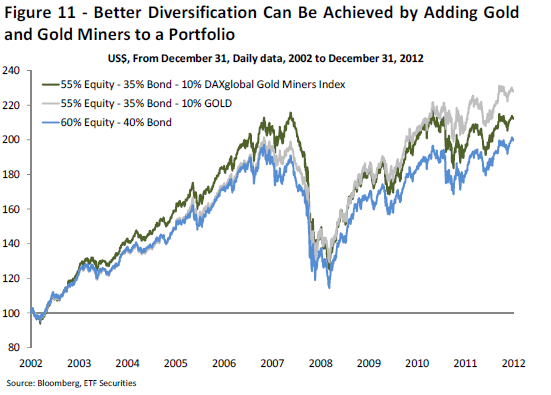

Despite the poor performance of gold miners’ shares over the past couple of years, investors should not disregard the potential benefits of investing in the mining sector. Over the past ten years, gold miners have tended to outperform the gold price during periods of rising global business activity, as measured by the US ISM Manufacturing index (Figure 2). In addition, in terms of portfolio allocation, an investor can potentially benefit from broader diversification and both gold and gold miners appear to have good diversification properties. The table below (Figure 10) shows how the risk-return profile of a portfolio has been improved by adding gold and gold miners’ shares to an allocation of bonds and equities. Although gold has offered the best opportunities in terms of improving the risk-return profile, a basket of mining stocks can also aid diversification of a traditional bond and equity portfolio (Figure 11).

An investor that substituted 10% of his equity and bond exposure with the returns of the DAXglobal® Gold Miners Index would have potentially increased his portfolio returns by 0.7 percentage point p.a. and decreased the riskiness of the portfolio by almost 4 percentage points. This portfolio would therefore have provided a higher Sharpe ratio compared to a more traditional allocation. However, a portfolio allocating 10% of its total exposure to gold would have had the best Sharpe ratio, as gold’s low correlation with other asset classes allowed it to substantially improve the risk-return profile of the portfolio.

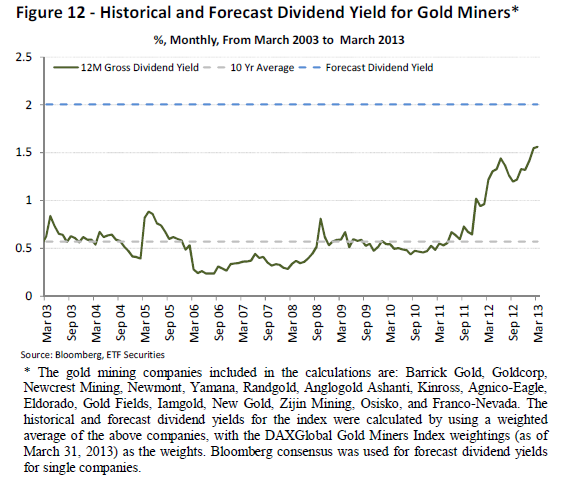

Yield investors looking for income might also find gold mining stocks increasingly attractive. Although dividend yields in the gold mining industry have traditionally been low compared to other sectors, some companies are now distributing bigger dividends (Figure 12). Over the past six months, average dividends distributed by gold miners have more than doubled to over 1.5%. This trend is likely to continue as scarcity of profitable projects is increasingly forcing companies’ management to reward investors via higher dividends.

Conclusions

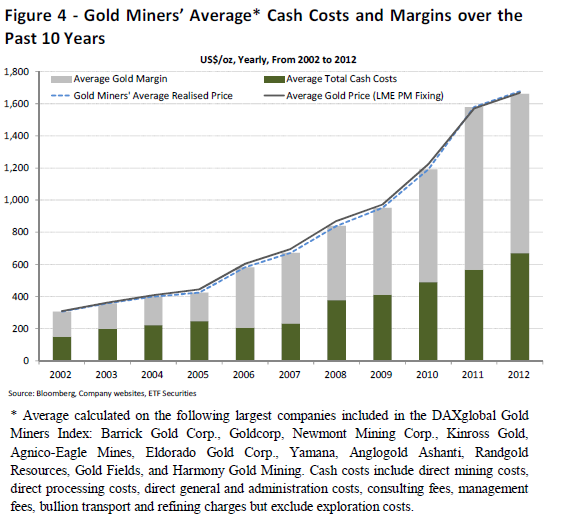

Gold miners’ shares have historically tended to be strongly correlated with the gold price, but this trend has declined in recent years. While the business fundamentals of miners as measured by margins and cash costs appear robust, a closer inspection of exploration and capital expenditures reveals a completely different picture. Lack of new discoveries, coupled with extinguishing brown-fields, has left mining companies with a production gap and cost that has undermined their performance. The introduction of gold ETPs has also provided investors with a more direct alternative to gaining exposure to gold price moves. However, mining companies have become increasingly aware of the lack of transparency and overbudget projects in the industry and are undertaking some drastic changes to reverse the current de-rating to the gold price. Gold miners have historically tended to outperform gold during periods of rising global growth and their valuations have now dropped from a substantial premium, to a discount to broad mining sector valuations, indicating likely limited scope for further de-rating. In addition, for investors that want yield, gold miners are starting to increase their dividend payments. With China and the US showing signs of economic recovery and equities back in favour, there may be scope for miners to begin to claw back some of their performance gap to gold.