SPY Snaps Back Like a Rubber Band

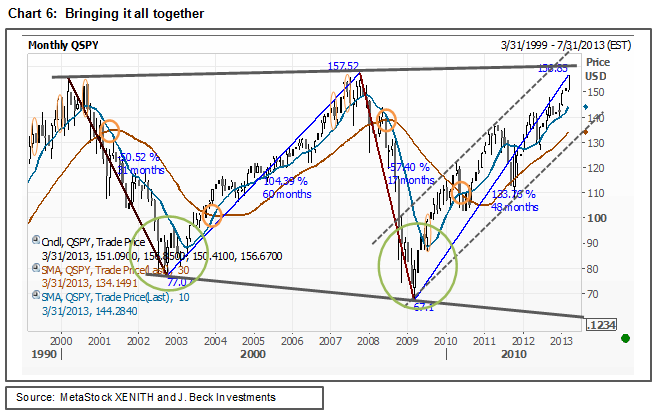

A good analogy of the stock market is that it can act like a rubber band and the tighter it is stretched without breaking, the faster and sharper it will snap back. For example, the 31 month and 50.52% decline for SPY was followed by one of the longest cyclical bull markets in recent memory, lasting 60 months and gaining 104% through its October 2007 peak (157.02). On the other hand, the 2007-2009 bear market lost 57.40% in the span of just 17 months. In other words, the rubber band did not break, but it was stretched tighter and the bounce has been sharper as SPY has gone up 133.76% in 48 months.

So What Now?

SPY is now testing the peaks made back in 2000/2007 or the top of the two prior bubbles. At this point the bulls and the bears are likely to become very vocal. The bulls will site undervalued equities, or that this is the start of another new bull market, or “it’s different this time.”

The bears may say that there is no ground for the market to be at these elevated levels, or we are setting up for a devastating drop.

I think that they are both somewhat off base, however.

The bulls are correct that this market can still sustain somewhat higher, but wrong that this is the start of a structural bull. The bears have it right that we are headed into a deeper and more extensive decline (or worse, the next cyclical bear market), but they are off on the timing. Yes, SPY will be tested at this formidable level of supply, but the technical evidence is suggesting that although late in the ballgame, this rally can still sustain somewhat higher. For example, key daily/weekly/monthly moving averages are still trending higher; the March 2009 uptrend channel is still intact; the sector/market breadth analysis suggests a healthy market; and relative outperformance compared to many international/emerging equity markets may be forcing global money managers into the US in search for outperformance.

There are also no major signs of distribution or speculation developing, which are typical near the end of a cyclical bull market. With that said, near-term distribution is evident by the 3/25/13 and 4/01/13 negative outside days, but these may be alluding to just a normal and healthy correction before perhaps one final rally higher.

So how high is high? A breakout above the 2000/2007 peaks (155.75/157.52) could result in a number of things that could push SPY even higher. For example, it could: 1) capitulate the bears, squeezing SPY higher; 2) force the sideline money (neutral camp) into the market; 3) push underperforming hedge funds benchmarked to the S&P 500 to chase this market resulting in a performance driven rally; 4) bring in retail clients that feel as if they have missed this whole bull market and now the boat is leaving without them; 5) et. al. If any of these happen, then SPY can climb to the top of the multi-year broadening top pattern near 160 or even to the top of the 2009 uptrend channel closer to 168-170 before a major top develops.

J. Beck Investments is an independent provider of technical research for ETFs.