3. Funded pension systems. Rather than pay-as-you-go systems (such as the Social Security program we have in the US), many emerging market countries have self-funded retirement systems. So while the US fiscal position may begin to deteriorate by the end of the decade as the burden of an aging population pushes up pension and healthcare spending, most EM countries have limited this risk by reforming their pension systems.

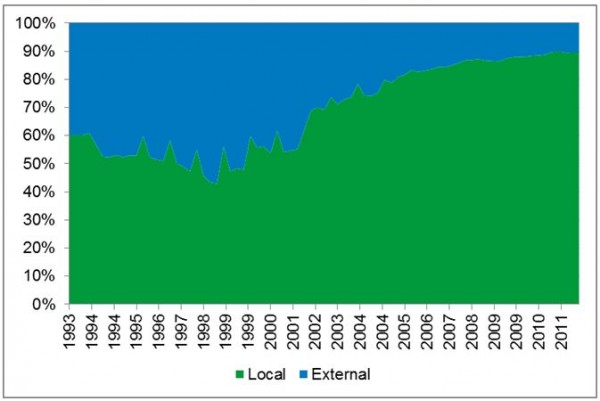

4. Rise of local currency bond markets. Because emerging markets have been issuing more obligations in their local currencies, rather than a hard currency like USD, they have a reduced reliance on external funding. While we still see active issuance in USD EM bonds, stronger EM issuers have lessened the potential for a currency crisis by matching their income and funding currencies through the issuance of local currency debt.

Composition of Emerging Market Debt

Meanwhile, in addition to the improving credit quality of this asset class, it’s also become increasingly available to investors in the form of ETFs. Before the first EM bond ETF was launched in 2007, it was virtually impossible for an individual investor to get their hands on these securities. And at the time, not many wanted to. But as interest in EM debt has grown the category’s assets under management have swelled to $13.6 billion, and there are now 16 EM bond ETFs to choose from ranging from broad to more country specific exposures.

Even with the improved risk profile, it’s still important to understand that emerging market debt is a volatile asset class compared to more traditional bond investments. Investors should consider their personal risk profile and portfolio objectives when choosing how much to invest, if at all. More conservative investors may want to avoid significant exposure to the category, while aggressive investors with high-income goals could allocate more (Russ K advocates 10-30% of a fixed income portfolio). If EM bonds are right for you, the increasing number of EM bond ETFs can give you the opportunity to invest in a previously difficult-to-access market.

Matt Tucker, CFA, is the iShares Head of Fixed Income Strategy.

[1] G7 countries include France, Germany, Italy, Japan, Canada, the United States and United Kingdom.

[2] Credit ratings are assigned by Nationally Recognized Statistical Rating Organizations based on assessment of the credit worthiness of the underlying bond issuers. AAA bonds (investment grade) carry the highest credit rating. Below investment-grade is represented by a rating of BB and below. Ratings and portfolio credit quality may change over time. Unrated securities do not necessarily indicate low quality.