So, what is the right level of cash holdings for an investor? That of course depends on each individual investor. But the charts above illustrate that many investors could benefit from setting cash holdings at levels to meet expected near-term expenditure needs, such as covering daily expenses or paying regular bills like mortgage or car payments. In other words, keep cash stable at levels that match expected near-term expenditures and then focus on managing the rest of the portfolio to fit longer-term investment objectives and risk levels rather than using cash as a market or risk timing tool. This particularly applies to investors with long-term investment horizons where the probability that a typical strategic portfolio (such as the traditional 60% stock/40% bond portfolio) will underperform cash over longer periods is small.

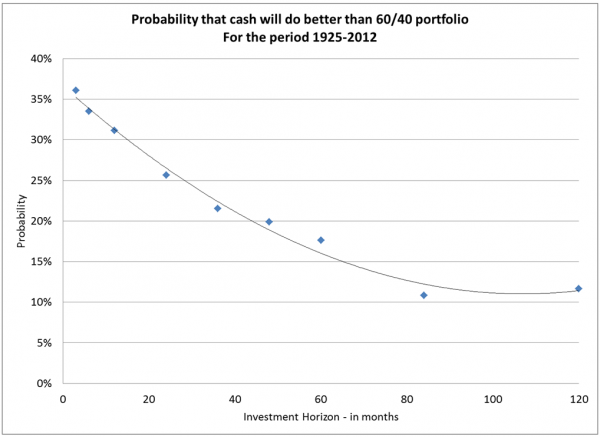

To illustrate this last point I have constructed a hypothetical 60/40 portfolio with data going back to 1925, and I’ve compared its returns over various horizons with the return of cash investments over time[2]. The chart below shows the probability that over various horizons (from 3 months to 10 years) the return of cash will be higher than the 60/40 portfolio.

Across all the 10-year periods from 1925 to 2012, roughly only 1 in 10 showed cash with better returns than the 60/40 portfolio. Even for horizons as short as 1 year, only 1 in 4 of all 1-year periods since 1925 showed cash with better returns than the 60/40 portfolio. These statistics are, of course, no guarantee than the next year or next 10 years may not be one of those periods. But for most investors, time spent making sure their overall portfolio matches their risk tolerance and investment objectives will likely be more productive than time spent managing their cash holdings.

Daniel Morillo, PhD, is the iShares Head of Investment Research.

[1] The return of the non-cash portion of the portfolio is, for every month, the weighted average of the total return of the S&P 500 and the total return of 50/50 mix of intermediated Treasury bonds and long-term corporate bonds. The weights are given by the relative weights to equity and fixed income reported by the survey for that month. Data for the S&P 500 returns as well as government and corporate bond returns is from the Morningstar SBBI database.

[2] The 60/40 portfolio is constructed as the 60/40 weighted average of equity and fixed income monthly total returns. For equities I used equity returns as reported by the Morningstar SBBI database. For fixed income I use a 50/50 mix of the returns for intermediate government bonds and long-term corporate bonds, also from the Morningstar SBBI database. For cash returns I use 1-month Treasury bill returns as reported by the Morningstar SBBI database.