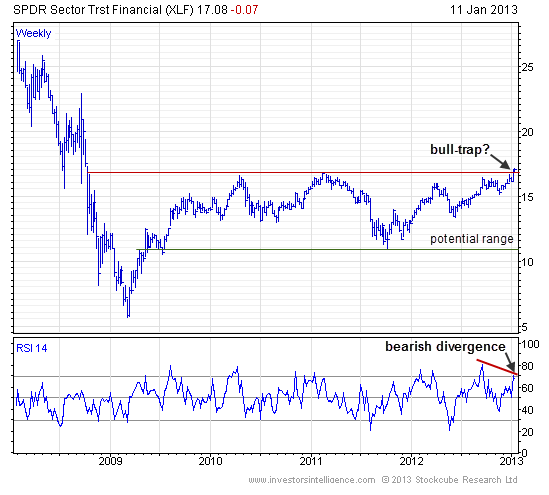

These banks are among the top stock holdings in Financial Select Sector SDPR (NYSEArca: XLF). The sector ETF is trying to break out to post-crisis highs for the third time at a key resistance level. [Financial ETF Near Four-Year High Eyes Breakout]

Like the S&P 500, Financial Select Sector SDPR is testing a major resistance ceiling, said Coe at Investors Intelligence. “Although the fund is at its highest level since October 2008, trading is yet to pull away decisively from resistance and that is a negative,” he wrote.

Emerging market ETFs

ETFs benchmarked to developing economies have outperformed the S&P 500 for several months. Related ETFs such as iShares MSCI Emerging Markets (NYSEArca: EEM) and Vanguard FTSE Emerging Markets (NYSEArca: VWO) have seen very strong inflows in early 2013. [Investors Flocking to Emerging Market ETFs Amid Rally]

Yet EEM has displayed several “gaps” higher recently that could mean the rally is getting tired, Coe points out.

Meanwhile, the relative chart versus the S&P 500 has started to break its uptrend of the past four months. “That implies underperformance is commencing and that will put the general market rally under threat,” the technical analyst said.

S&P 500