“That trend looks to be reasserting and should enable a visit to the 2012 high,” Coe wrote on the utilities ETF. “The relative chart versus the S&P 500 is moving up from the lower end of its three year range. That equates to good relative upside potential, with limited room for underperformance. It is a defensive area and has a present yield of 3.88%.”

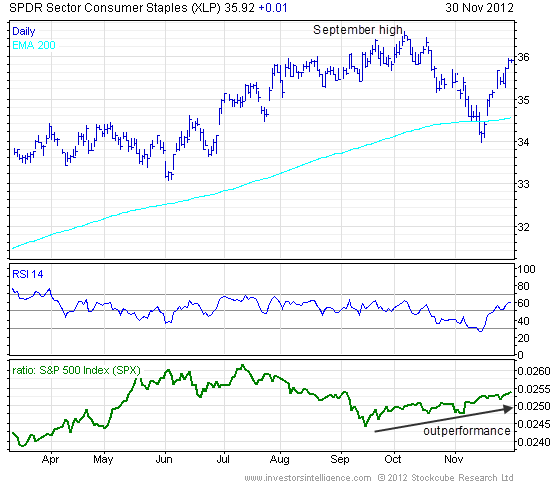

He also likes Consumer Staples Select Sector SPDR (NYSEArca: XLP), which has been outperforming the general market since mid-September. [Going International with a Consumer Staples ETF]

In mid-November, the consumer staples ETF rallied after finding support at the 200-day moving average. “The subsequent bounce has reasserted the primary uptrend and a break of the September high of $36.59 looks likely over the next couple of weeks,” Coe said.

Utilities Select Sector SPDR