“Why people keep piling on junk bonds with yields at these record low levels is just beside me,” said Michael Mullaney at Fiduciary Trust, in the FT story

“There’s no doubt this is a borrowers’ market. Those investors who are forsaking credit quality in reach for yield face a material risk if we see a back-up in markets,” added Adrian Miller, global markets strategist at GMP Securities.

Companies have been taking advantage of investor demand for bonds by issuing record amounts of corporate debt this year.

“2012 continues to be the year of the corporate bond as companies remain both willing and able to take advantage of near record-low borrowing costs,” according to Benjamin Streed at Raymond James.

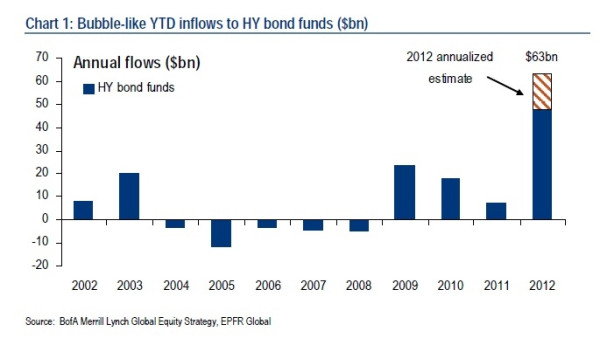

Bank of America Merrill Lynch notes “bubble-like” inflows to high-yield funds in 2012, which are at a record pace.

“So much money has flooded into the junk-bond market from yield-hungry investors that weaker and weaker companies are able to sell bonds,” The Wall Street Journal reports. “Credit ratings of many borrowers are lower and debt levels are higher, making defaults more likely. And with yields near record lows, they add, investors aren’t being compensated for that risk.”

Yet high-yield ETFs have remained strong despite these bubble fears, with the 50-day average providing solid support.

SPDR Barclays Capital High Yield Bond

Full disclosure: Tom Lydon’s clients own HYG, JNK and LQD.