Q:With the onset of the Dodd-Frank Act, will large volumes of preferreds be called?

A: In response to the new rules, banks can either call their preferred securities and replace them with another form of capital if needed, or they can let them continue to mature. The current low rate environment is increasing the possibility of securities of being called similar to any other security that has a call option, and in some cases, banks have the option of calling the securities even prior to normal five-year call protection.

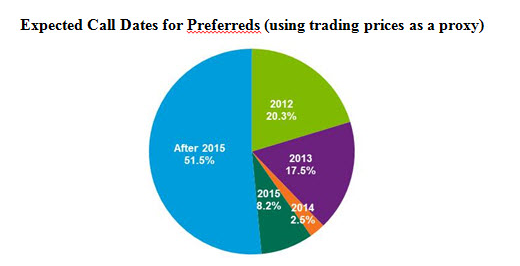

But at this point, we believe it is highly unlikely that banks would call all of their trust preferred securities. Many of them have publicly stated their intention not to – for example, JP Morgan only plans to call half of their trust preferred issues. Instead, we believe banks will call their preferreds over time. While it is always difficult to predict what decisions management will make, we believe the chart below – which illustrates expected call dates for preferreds within PFF if prices remained at current levels and issuers were solely motivated to call based on trading prices – shows a more likely scenario.

The bottom line is that despite these regulatory changes, investors can still consider using preferred stock as part of a diversified income-oriented portfolio. While Dodd-Frank may change the treatment of trust preferred securities, we do not believe it will curtail the supply of preferreds, and as new preferreds are offered, they should continue to make their way in to PFF.

Mariela Jobson is Vice President and portfolio manager in BlackRock’s iShares Index Equity Portfolio Management Group.