This discrepancy suggests that money in gold ETFs tends to be “sticky” with more of a long-term mindset, compared with the futures market. Gold ETF investors haven’t run for the exits during gold’s pullback from over $1,900 an ounce. [Gold ETFs Could Speed Metal’s Decline]

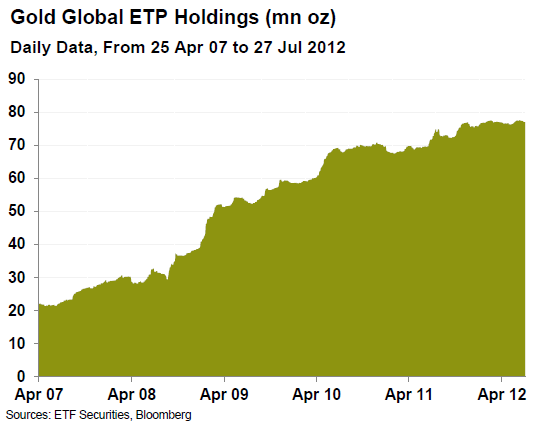

Bullion held in physically backed exchange traded products is just shy of 2,400 metric tons, according to data from Bloomberg. This figure translates to nearly 80 million ounces of gold held in exchange traded products listed around the globe.

The largest such ETF is SPDR Gold Shares (NYSEArca: GLD).

“Analysts generally say it’s difficult to quantify the effect of funds that hold bullion on the price of gold, but agree that the growth of their holdings has helped fuel the surge in the metal’s price in recent years,” The Wall Street Journal reported earlier this year.

The relationship between ETF holdings and the price of gold isn’t clear-cut and may not be a reliable indicator for short-term moves, according to Wall Street analysts. [Measuring the Impact of Gold ETFs]

Full disclosure: Tom Lydon’s clients own GLD.