If you’re holding long-term Treasury bond exchange traded funds (ETFs), look out below.

That’s because Treasuries have gotten hammered lately. For confirmation, check out ProShares UltraShort 20+ Year Treasury (NYSEArca: TBT), which we’ve been writing about since it crossed the 50-day moving average. In the last two weeks alone, it has surged 12.4% and is now well above its 200-day. It’s also up big today:

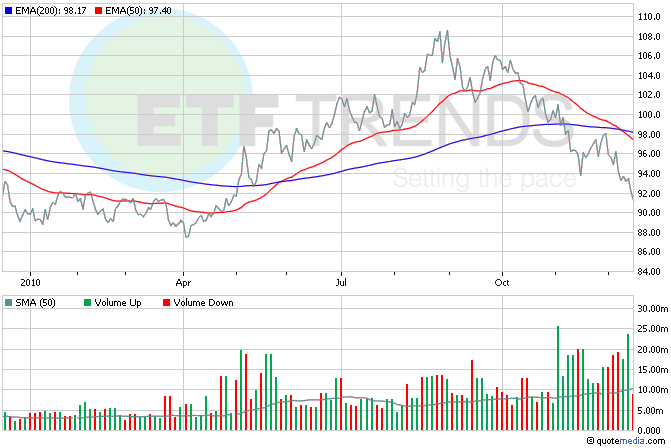

On the flip side, this chart of iShares Barclays 20-Year Treasury Bond (NYSEArca: TLT) looks ugly:

The Federal Reserve’s bond buying program looks like it’s baked in here. Sometimes investors are slow to look at what their positions are doing, but this is one area where you definitely want to be paying attention.

The reversal means that bond prices are falling and yields are rising; if you bought bonds at the higher price, you could be losing principal right now. If you’re not paying attention, these moves could be a cold splash of water in the face at month-end.

What should you do? Based on our simple trend following strategy, the recent plummet in long-term Treasury bonds is a sell signal. TLT is more than 6% below its long-term trend line, and it has dropped more than 11% in the last three months.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.