The news that the Chinese government is preparing to raise interest rates to rein in its fast-growing economy and fight inflation is helping to drive down shares of equity and commodity exchange traded funds (ETFs) in early trade.

Chinese officials reported that the nation’s rate of inflation in October increased to the highest level in several years. Commodities are really feeling the brunt of the rise in interest rates today, with silver getting hit the hardest. Traders are concerned that inflationary pressure in China will lead the country to tighten monetary policy while instructing banks to further reign in loans. This change will impact the world economy by limiting the capability of Chinese consumers to purchase goods and services. Also, the Chinese media reported the country is readying new regulations that will forbid foreign companies from buying property there and limit foreigners to purchasing just one residential unit for their own use. Global X China Consumer (NYSEArca: CHIQ) is down nearly 3% today. [Emerging Markets Lift Consumer ETFs.]

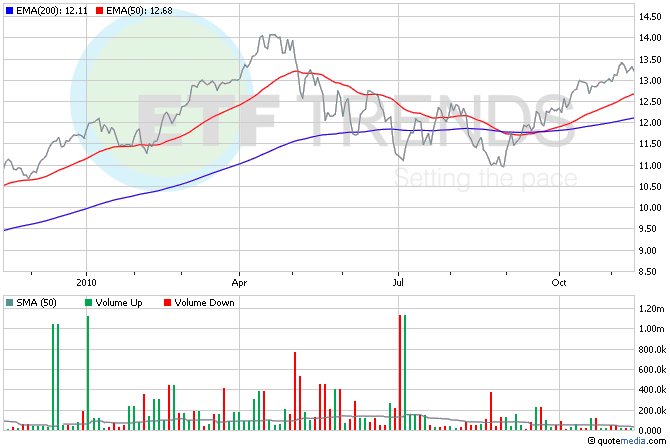

Investors are also keeping a wary eye on the G-20 meeting in Seoul, South Korea, where leaders released a joint statement that urged that markets be allowed to set foreign-exchange rates. Leaders from the Group of 20, which includes large developed and emerging economies, failed to agree on policies about trade and currency manipulation that could stoke protectionism and a trade war. iShares MSCI South Korea (NYSEArca: EWY) is down 2.6% so far today. [South Korea ETF Boosted by Sentiment.]

One stock that is doing very well today is Walt Disney Co. (NYSE: DIS), which is up more than 4.5% so far even though the entertainment company reported a 7% profit decline on lower earnings at its ESPN cable channel, as well as in its theme parks. The gains aren’t doing much to help PowerShares Dynamic Media (NYSEArca: PBS), which is down nearly 1% so far today. Disney is 4.6% of the ETF. [Is Innovation Hurting Media ETF?]

Gregory A. Clay contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.