In early morning trading shares of financial stocks appear to be recovering from the slide that began last week based on worries that the mortgage foreclosure debacle might lead to higher cost, lawsuits, congressional inquiries and other problems for lenders.

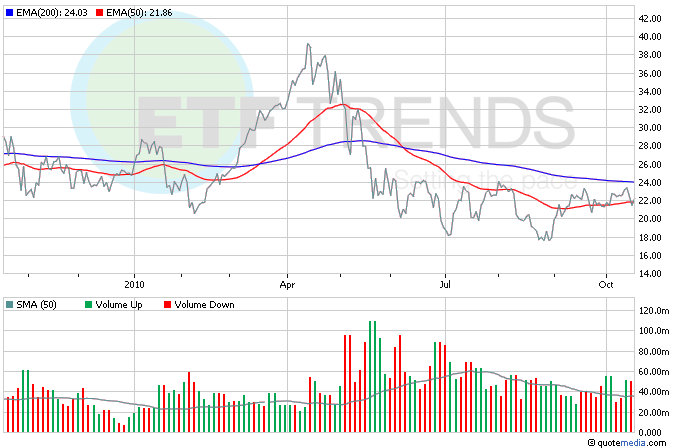

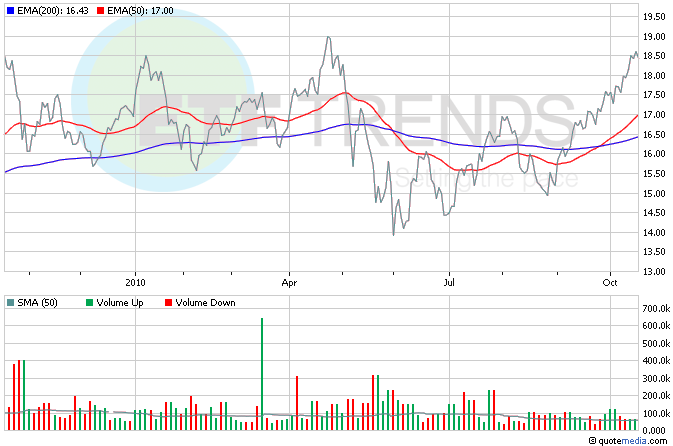

According to the ETF Dashboard, financial stocks are in the driver’s seat led by Regional Bank HOLDRs (NYSEArca: RKH) and SPDR KBW Bank (NYSEArca: KBE), both of which are up at least 2%.

Shares of Citigroup (NYSE: C) and Bank of America (NYSE: BAC) were among those hammered last week, but Citigroup reported that third-quarter income exceeded analyst estimates. Leveraged financial ETFs are also surging this morning. Direxion Daily Financial Bull 3x (NYSEArca: FAS) is up almost 3% in early trading. [Financial ETFs Get Their Color Back.]

The U.S. dollar is starting recover this morning against the euro and yen. The dollar plunged against other major currencies early last week as traders bid the price down based on their expectation that the Federal Reserve will restart its quantitative easing program. Traders are expecting this asset repurchase program will be approved at the November Fed meeting and will result in increased liquidity flooding the market which should boost the stock market. But Fed Chairman Ben Bernanke gave a speech on Friday that may have disappointed investors because he did not lay out specific details about how the program will be implemented. Gold futures are down this morning as the dollar is strengthening, bolstering funds like iShares Barclays 20+ Year Treasury Bond ETF (NYSEArca: TLT), which is up almost 1% this morning. [Corporate Bond ETFs Catch a Wave.]

Oil & Gas stocks are lagging the market a bit this morning, dragged down by Halliburton Company (NYSE: HAL) reporting a third-quarter profit increase, but revenue fell short of analyst expectations, sending shares lower. PowerShares Dynamic Oil Services (NYSEArca: PXJ) is down 0.8% so far today; Halliburton is 5%. [Oil Exploration ETFs a Bargain Hunter’s Dream?]

Gregory A. Clay contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.