It just goes to show that you can’t predict the markets. Despite analysts’ calls for the steel exchange traded fund (ETF) to plunge, it’s done exactly the opposite.

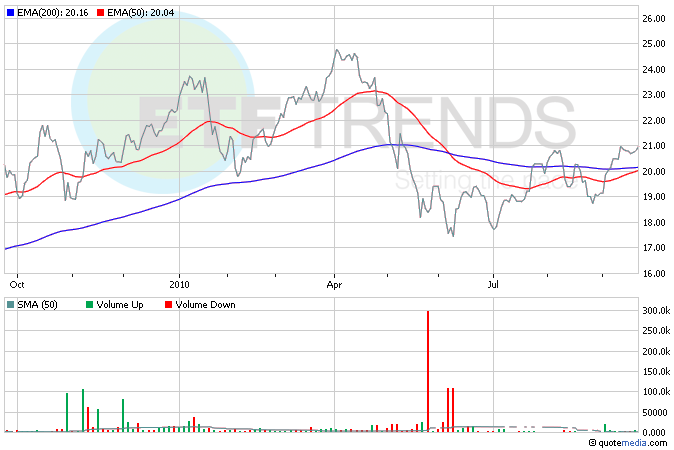

Steel prices have started to climb on demand for it in everything from ships to tin cans, appliances and oil pipelines. Robert Guy Matthews for The Wall Street Journal reports that depending on the type of steel and its location, prices have jumped between 1% and 12%. In the last month, steel ETFs have gained between 4% and 6%. [6 ETF to Play Obama’s Jobs Plan.]

As is so often the case, China is a huge culprit. The country slashed steel demand to meet the government’s year-end energy-savings target. Before year end, China’s steel mills will cut production by 3% to 5%. [Which ETFs Benefit from China’s Industrial Output?]

Demand in cars may keep prices elevated. Although aluminum is a major auto component, steel is still the dominant one, thanks to lower prices and less volatility, says Pratima Desai for Reuters. The development of lighter and stronger steel has put it back in favor for use in these fuel-efficient times.

There are two ETFs to play the steel industry directly, according to the ETF Analyzer. Both of the funds below hold the stock of companies involved in steel production; there’s currently no physically-backed or futures-based steel ETF.

- Market Vectors Steel ETF (NYSEArca: SLX): The United States is the sole country in this fund.

- PowerShares Global Steel (NYSEArca: PSTL): Top countries are Japan, the United States, Brazil and South Korea

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.