Japan’s Central Bank has long kept a heavy hand on its currency, heading off any signs of inflation and reducing the amount of extra yens floating in the market. However, the Japanese government may start to ease its monetary policy, which may reverse the gains its exchange traded funds (ETFs) have seen in the last few months.

The new Japanese Foreign Minister Seiji Maehara remarked that the Japanese yen has “strengthened more than indicated by the actual strength of the Japanese economy” and that “speculative moves” has artificially raised the yen above the fundamentals, report Gordon Fairclough and Rebecca Blumenstein for The Wall Street Journal. [Why Currency ETFs Yen for an Intervention.]

Maehara also stated that “going forward, there may be a possibility for the Japanese government to show its very determined intent to keep the currency from strengthening.”

The yen stumbled in trading on Friday, but it is yet unknown whether it was the result of anxious currency traders or from a direct intervention from the government. Japanese yen ETFs are flat so far in today’s trading.

For more information on the Japanese yen, visit our Japanese yen category.

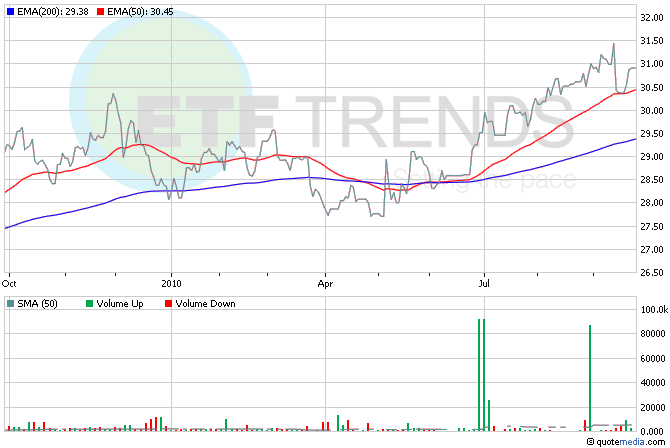

- CurrencyShares Japanese Yen Trust (NYSEArca: FXY)

- WisdomTree Dreyfus Japanese Yen (NYSEArca: JYF)

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.