Yesterday concluded the worst month the Dow has seen since 2001. Today, the markets are getting off on the right foot by jumping more than 200 points in early trading. Global and industrial metal exchange traded funds (ETFs) are leading the charge.

The ETF Dashboard shows that among the leading ETFs this morning are iShares MSCI Sweden (NYSEArca: EWD) and Market Vectors Steel (NYSEArca: SLX), both of which are up more than 5%.

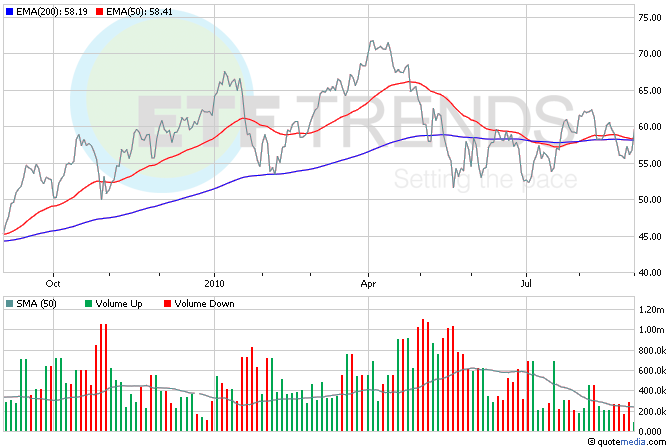

Much of the optimism comes from manufacturing, which grew faster in August. What’s more, managers’ desire to hire people has risen to the highest level in almost three decades. In the coming months, watch out: manufacturing growth may slow, signaled by a new orders report, which dipped to the lowest level since June 2009. Market Vectors Steel (NYSEArca: SLX) is up more than 5% this morning, though it’s down 6% in the last 10 days. [5 ETFs That Could Move on Manufacturing.]

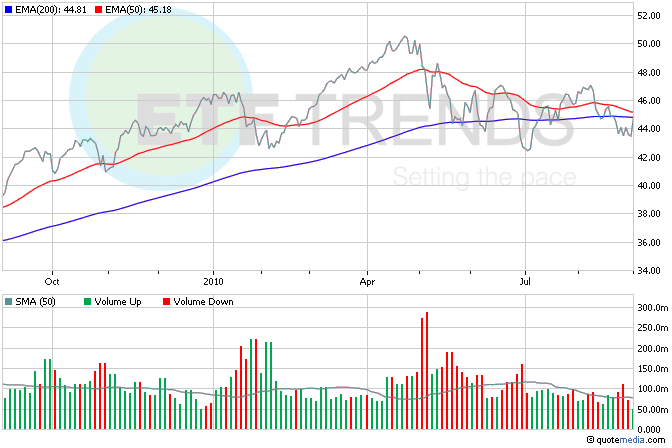

After sinking 6.2% in August, the Nasdaq is off to a strong start this morning. The tech-heavy index is up 3% today, thanks to gains in large-cap technology companies. PowerShares QQQ (NASDAQ: QQQQ), which tracks the Nasdaq, is up 3.3%. In the least three months, it’s down 4.9%. [Tech ETFs to Skip If You’re Bearish Like Cisco.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.