Economists were expecting the consumer mood to have darkened, but the final reading was worse than expected. That and other news pressured most exchange traded funds (ETFs) lower.

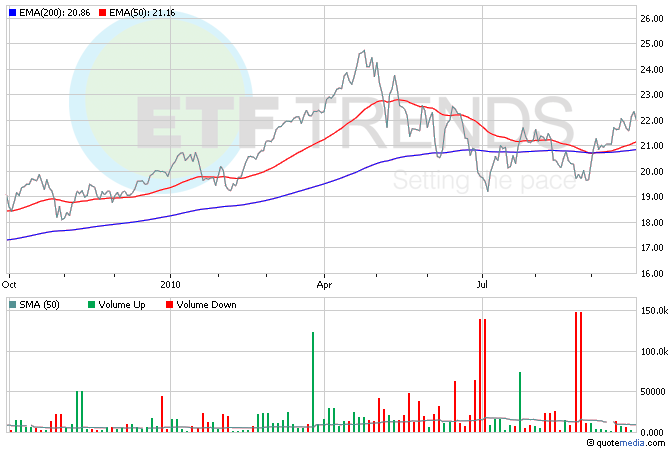

Renewed concerns about the domestic economy sent investors overseas and, on our own soil, to safe havens. According to the ETF Dashboard, two funds leading the charge are iShares MSCI Turkey (NYSEArca: TUR) and PIMCO 25+ Year Zero Coupon Treasury (NYSEArca: ZROZ), both of which are up about 1%.

Consumer confidence fell sharply in August, with the Conference Board’s index falling to 48.5, well below the 52 economists expected. It’s the lowest reading since February. PowerShares Dynamic Consumer Discretionary (NYSEArca: PEZ) sank more than 1.5% on the reports. [Two Retail ETFs That Cater to the Frugal.]

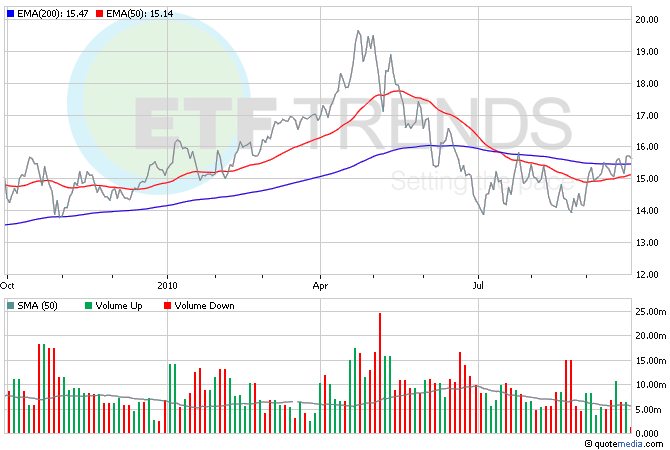

Home prices edged up 0.6% in July from June, according to the Case-Shiller 20-City Home Price Index. Year-over-year, prices rose 3.2%. The slow gains only further illustrate the housing market’s weakness – new home sales are near record lows. SPDR S&P Homebuilders (NYSEAca: XHB) is down 0.5% so far today. [Homebuilder ETFs: At the Bottom?]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.