On the final day of trading of the best month the markets have seen in 71 years, stocks and exchange traded funds (ETFs) turned higher following a slate of positive economic reports.

The number of unemployed workers seeking benefits fell by even more than anticipated last week. That’s the good news. The so-so news is that the decline isn’t enough to chip away at the high level of unemployment.

The final second-quarter GDP numbers are in: the figures were revised upward to show 1.7% growth in the quarter, up from the previous estimate of 1.6%. On both reports, major indexes are moving on up, led by the SPDRs (NYSEArca: SPY), which is up about 0.6% so far today.

If you think gold’s climb is done, today isn’t the day to be proved correct. Futures on the yellow metal hit yet another intraday record: $1,317.50 an ounce, although it finally settled at $1,316.20 an ounce. ETFS Physical Swiss Gold Shares (NYSEArca: SGOL) is down just slightly so far this morning. [Dollar Trips, Gold ETFs Gain.]

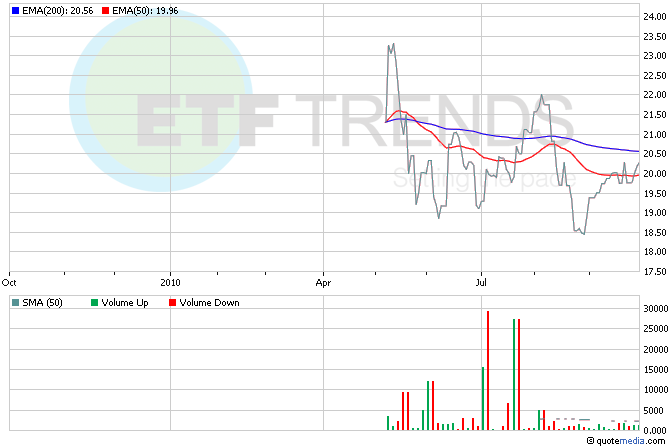

More bank takeovers in Ireland have investors concerned about the state of the Green Isle’s economy. Billions are expected to be injected into two of the country’s biggest banks. iShares MSCI Ireland (NYSEArca: EIRL) is up about 0.5% this morning; the fund only has a 13.8% weighting in the financial sector. [Ireland ETF Hit By Negative GDP.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.