The drop-off in natural gas prices is touching other areas, mostly notably coal exchange traded funds (ETFs).

Natural gas and gas prices are down, causing coal and iron ore prices to slump alongside them. It’s simple economics: once natural gas because cheap enough to use heavily, it makes coal a lot less appealing for power plants, reports Mark Peters for The Wall Street Journal. [Will Coal ETFs Spike In the Summer?]

As long as natural gas is cheap, this trend could continue. Coal prices may not have much further to fall before declining production and falling stockpiles begin to prop up the market. [Will Nuclear ETFs Get A Breath?]

Javier Blas and Jack Frachy for The Financial Times reports that lower steel production will also affect the commodity market. The price of steelmaking commodities iron ore and coking coal are forecast to drop next quarter for the first time in a year, because of waning interest in steel.

Mining executives and analysts estimate that iron ore prices for the fourth quarter will drop by 10-15% and coking coal prices by 5-10%.

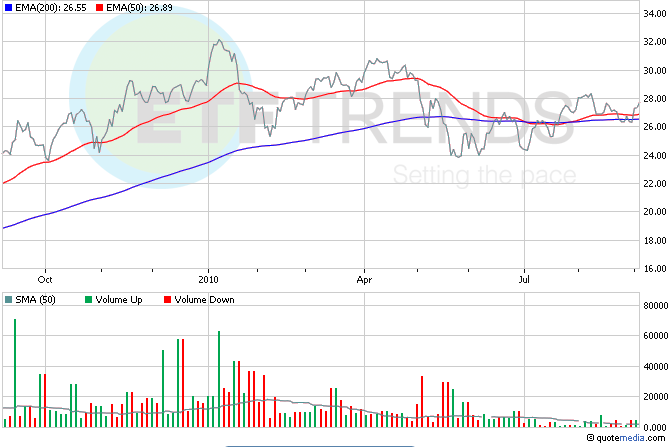

For more stories about coal, visit our coal category. For now, these ETFs are above their trend lines; sign up for alerts to be notified of any drop-off.

- Market Vectors Coal ETF (NYSEArca: KOL)

- PowerShares Global Coal Portfolio (NASDAQ: PKOL)

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.