South Korea may be a country of turmoil, but amid the chaos is opportunity in exchange traded funds (ETFs) if you look closely.

The overblown geopolitical climate is just one reason why South Korea may be a good opportunity for investors. Here are a few more reasons this economy may be one to watch in the coming months:

- Shares Are Trending Higher: Over the past three months, the Kospi has rallied by 11%. Shares are still cheap now, and they are undervalued, Louis Basenese for Investment U reports.

- Solid Growth: South Korea’s GDP is expected to grow by at least 5.75% this year, and their debt is low with balance sheets looking tight. The country is enjoying a current account surplus, thanks to strong exports, particularly in the area of semiconductors and automobiles. [Why South Korea Won’t Be Down For Long.]

- South Korea May be Getting A Promotion: As MSCI put it, South Korea “continues to meet most developed markets criteria… notably economic development, market size and liquidity.”This year the country narrowly missed getting its upgrade from emerging market status to developed status.

- Rising Exports: William Sim and Eunkyung for Bloomberg report that the Bank of Korea is looking at staving off inflation by increasing its benchmark interest rate to dampen price pressures. Export gains propelled South Korea’s economy to the fastest first-half expansion in a decade, fueling price pressures.[Why Emerging Market Small Caps Are Beneficial.]

- Housing Market: Although the housing market in South Korea may be in a correction phase over the short- to medium term following a decade-long boom, Moody’s does not expect a massive increase in the number of mortgages falling into negative equity and defaulting, Kim Yeon-hee for Reuters reports.

For more stories about the South Korea economy, visit our South Korea category.

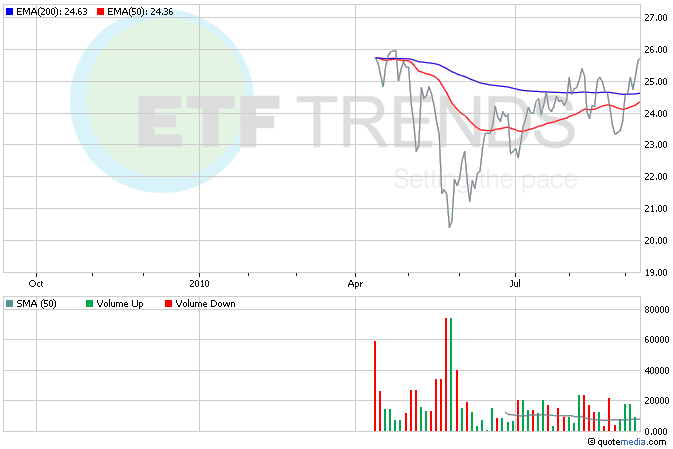

- iShares MSCI South Korea Index (NYSEArca: EWY): up 13.1% in the last three months

- IQ South Korea Small Cap ETF (NYSEArca: SKOR): up 15.6% in the last three months

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.