By all appearances in early trading, it looks like it’s shaping up to be a negative week for stocks and exchange traded funds (ETFs). Overnight, world markets fell on worries about the U.S. economic recovery.

According to the ETF Analyzer, the top-moving funds this morning are largely what they have been all week: leveraged and inverse ETFs, with a smattering of Treasuries and gold funds tossed in:

PowerShares FTSE RAFI Europe Portfolio (NYSEArca: PEF) is down more than 2.5% not long after the market open; major indexes in Germany, France and the United Kingdom declined on Friday. Analysts say that in the absence of market-moving news on Friday, the negative sentiment may hold through the weekend. [Dollar ETFs: Not the Only Falling Euro Plays.]

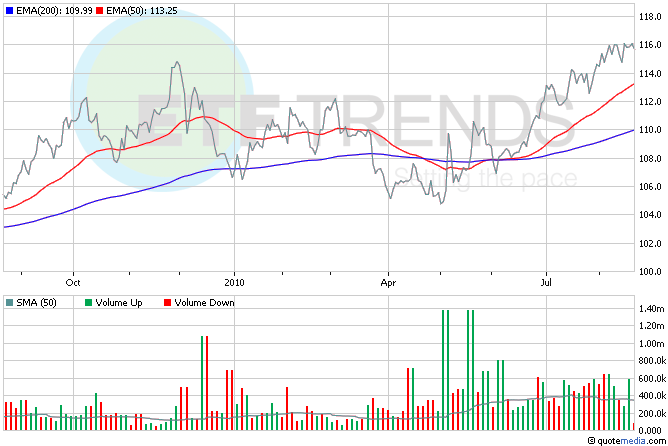

The Japanese yen is getting stronger, and it has watchers concerned about what this means for Japan’s economic recovery efforts. In the last year, CurrencyShares Japanese Yen Trust (NYSEArca: FXY) has shot up 8.9%. Japan’s finance minister pledged to watch the currency more closely. If the yen continues to get stronger, it could affect other Japan ETFs, such as iShares MSCI Japan (NYSEArca: EWJ), which has lost 3.3% in the last year. [Trends Spotted in Dollar, Yen, Euro ETFs.]

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.