According to the ETF Dashboard, Treasury bond exchange traded funds (ETFs) are gaining this morning on yet more discouraging news from the struggling real estate sector.

The top-moving fund early this morning is the PIMCO 25+ Year Zero Coupon U.S. Treasury Bond (NYSEArca: ZROZ), which at one point was up more than 3.5%:

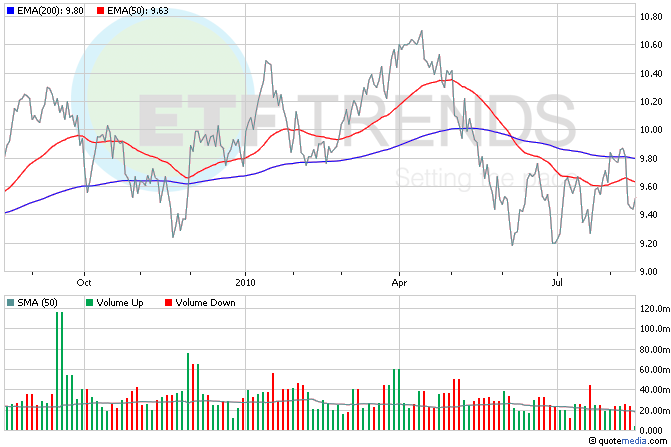

Homebuilder confidence fell for the third consecutive month last month, thanks to a glut of cheap foreclosure properties. It was the index’s lowest reading since March 2009. iShares Dow Jones U.S. Home Construction (NYSEArca: ITB) may have already priced in the negative sentiment – it’s down 0.5% so far today. Top component Lowe’s (NYSE: LOW) gave earnings this morning, saying it expected sales to rise 4% this year. Analysts are more bullish, predicting a 5% gain.

Japan’s economy showed more signs of slowing growth. The country’s GDP rose 0.4%, missing expectations. The slower growth can be blamed on low consumption, slower exports and a soaring yen, which is making Japanese goods less appealing overseas. In the last three months, iShares MSCI Japan (NYSEArca: EWJ) is down nearly 5%. Today, it’s down 0.2%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.