The summer travel season is in its waning weeks, which spells light volume and little market-moving news that would keep yesterday’s exchange traded fund (ETF) rally moving in the right direction.

According to the ETF Analyzer, the top funds moving today are those taking a bearish stance on the markets and safe-haven tools, such as Treasuries:

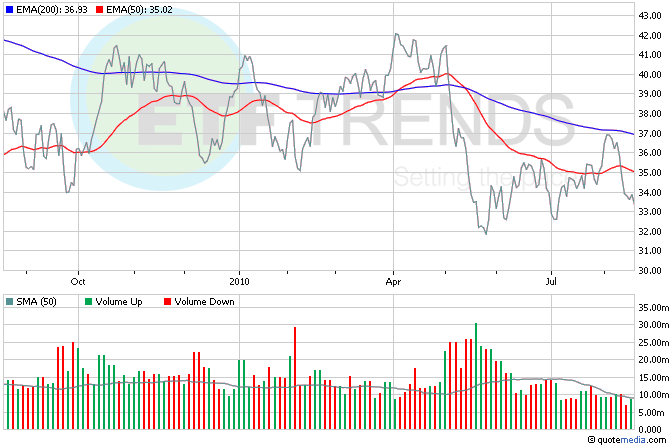

Oil ETFs fell after a report showed that the United States has more oil than it needs right now, fueling concerns about domestic demand. United States Oil (NYSEArca: USO) is down 1.6% so far today; for the last six months, it’s down 12.1%. [How Not to Get Burned By Commodity ETFs.]

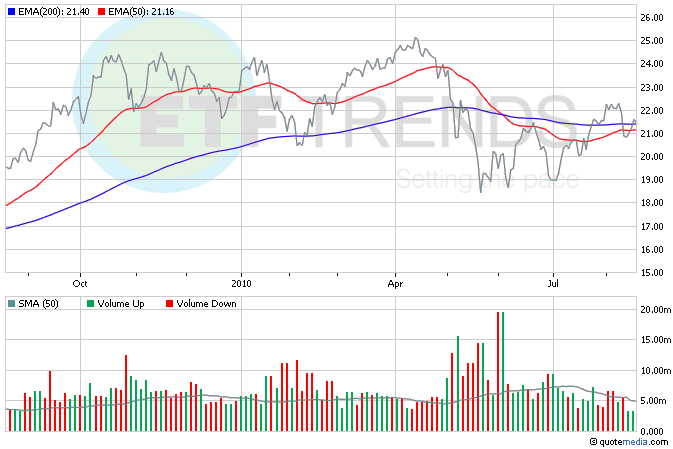

There’s a battle over in the world of potash, a popular fertilizer. BHP Billiton (NYSE: BHP) is now making its $38.6 billion bid for Potash Corp. (NYSE: POT) a hostile one, taking it directly to the shareholders. iShares MSCI Australia (NYSEArca: EWA) is down 1% this morning; BHP is 15.1% of the fund. [When In Drought, Agriculture ETFs Look Good.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.