Consumer spending rose modestly in July, but in these times of gloomy economic reports, this one was enough to keep the markets from turning further south.

According to the ETF Dashboard, overseas stocks and safe havens are back in fashion:

The retail figures don’t necessarily mean that consumers were shopping. In fact, the numbers were primarily driven by higher auto and gasoline sales, which accounted for 25% of the total sales. At department stores, the picture was less rosy – sales fell 1%. United States Gasoline (NYSEArca: UGA) is down 0.7% so far today. [Why Oil ETFs Are Rising.]

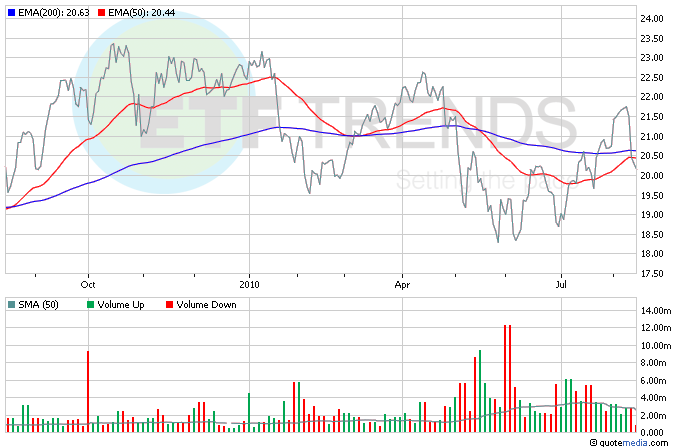

The eurozone economy grew a more-than-expected 1% in the second quarter, driven by Germany’s best performance since reunification. Germany’s export boom contributed to the 2.2% jump, which made up for slighter growth in Spain and Italy. iShares MSCI Germany (NYSEArca: EWG) is down this morning, but it’s up 2.5% in the last month. [Germany ETFs: Can the Momentum Continue?]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.