The Labor Department had bad news for anyone looking to a recovery in the nation’s unemployment numbers: it’s still ugly out there. Exchange traded funds (ETFs) and the broader stock market sank on the report.

The ETF Dashboard shows a rush to Treasury Bond ETFs and other safe-haven instruments as a result of the downbeat news. Go here to find out how you can see the Dashboard.

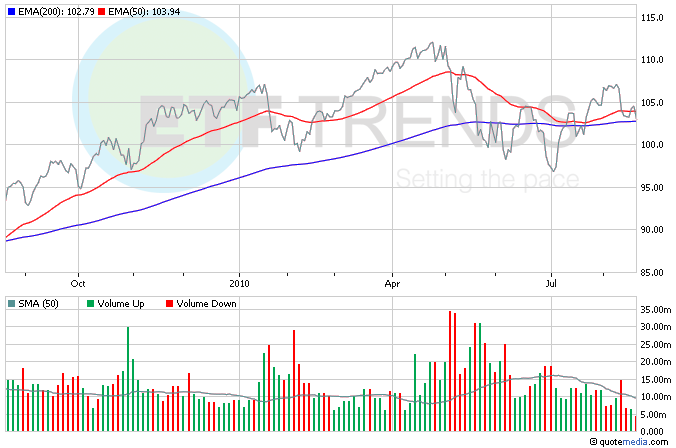

First-time jobless claims rose to the highest number in nine months – a figure that’s moving in decidedly in the wrong direction if anyone wants consumers to loosen the grip on their wallets. But other economic reports struck a conflicting tone. Leading indicators rose 0.1% last month, a signal that while the economy isn’t necessarily backsliding, it’s not moving forward, either. SPDR Dow Jones Industrial Average (NYSEArca: DIA) is down 1.4% so far this morning; in the last 10 days, it’s down 2.3%. [How the Dow Is Calculated.]

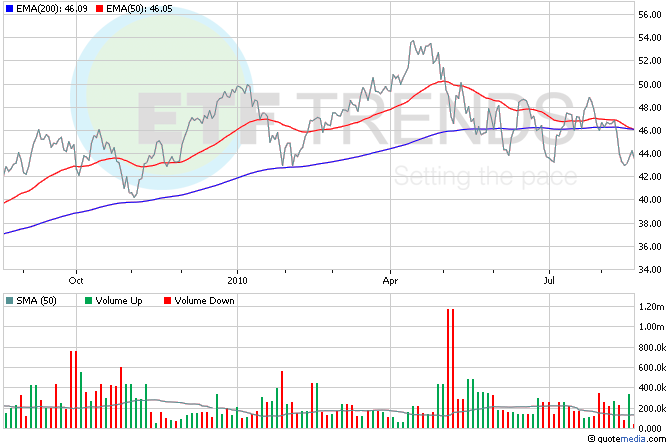

Intel (NASDAQ: INTC), apparently not content with being the world’s largest chip maker, is now making a play to become a major player in the security market with its acquisition of McAfee (NYSE: MFE). It’s the largest deal in Intel’s history and a sign of a broader trend in which well-positioned tech companies are staking claims in other fast-growing tech segments. The news doesn’t seem to agree with iShares S&P North American Technology-Semiconductors (NYSEArca: IGW), which is down 1.5% so far today. Intel is 8.5% of the fund. [Tech ETFs to Skip If You’re Bearish Like Cisco.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.