Finally, some economic reports to get excited about. Exchange traded funds (ETFs) and stocks were lifted on reports that industrial production surged a full percentage point in July.

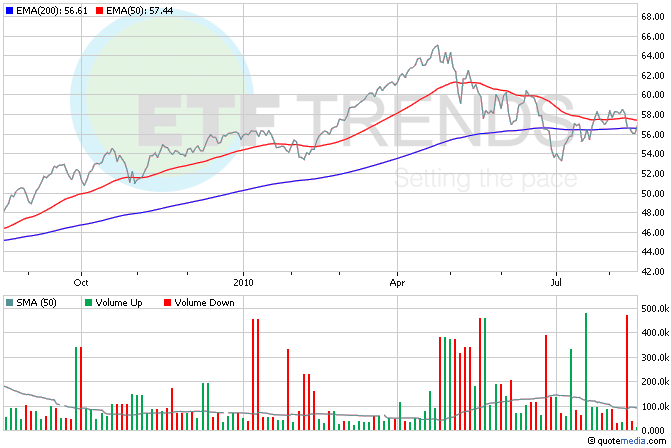

According to the ETF Analyzer, some of the top-performing ETFs early this morning include those focused on basic materials and base metals. The leading base metal fund so far today is the Global X Copper Miners (NYSEArca: COPX), which is up nearly 3%:

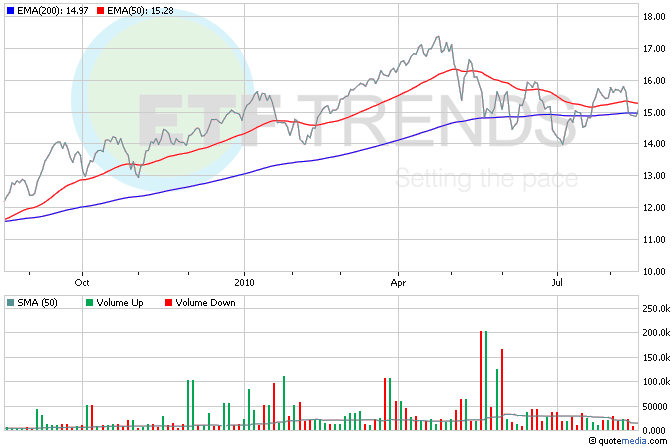

Factory output, which is the largest component of industrial production, rose 1.1% last month – the largest gain in almost a year. The numbers are primarily attributed to auto production that continued through summer. But even without that, output still rose 0.6%. First Trust Industrials AlphaDEX (NYSEArca: FXR) is up 1.5% so far today; in the last year, it has returned 15.6%. [5 ETFs to Play the Recovery.]

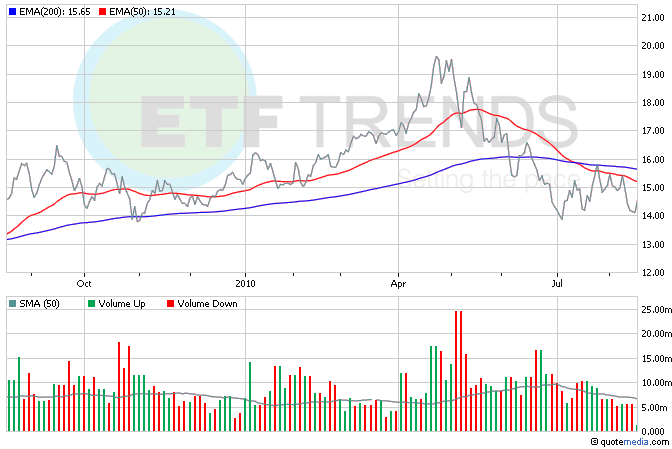

Giant retailer Wal-Mart (NYSE: WMT) said that its sales rose 3.6% in the second quarter, thanks to strength overseas. Wal-Mart also lifted its profit forecast for the full-year, despite weakness in the United States. iShares Dow Jones U.S. Consumer Services (NYSEArca: IYC) is up 1.3% so far today; Wal-Mart is 8% of the ETF. [Consumer ETFs: Going Overseas for Strength.]

Following on the heels of news that homebuilders are still feeling down about the housing market’s prospects is a report that housing starts rose less than forecast in July. The number of building permits issued declined to the lowest level in more than a year. SPDR S&P Homebuilders (NYSEArca: XHB), perhaps feeling that there’s nowhere to go but up, is up 2.3% so far today. [Homebuilder ETFs Take Hits After Negative Sentiment.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.