After wallowing in the doldrums for the better part of two decades, Japan’s stock market is finally attracting foreign money. One analyst thinks this might be the beginning of a huge bull run for Japanese exchange traded funds (ETFs).

Alexander Green of Investment U reports that foreign ownership of Japanese stocks rose from 23.5% to 26% ended in March, breaking a streak of three consecutive years in which foreign investment languished.

Since 1989, the Nikkei 225 is down 75%, dropping from a peak near 40,000 to today’s level of 10,000. No wonder foreign investment has languished. The index would need to appreciate 300% just to get back to its 1989 level.

Green thinks that a 300% run over the next decade is actually very reasonable. He reasons that:

- The Japanese market has rallied to such an extent before. During the 1970s, it generated a 344% return.

- Last August, the Japan’s Liberal Democratic Party was ousted in a landslide, ushering in promises of a new legacy of smaller government and business friendly policies.

- If Japan’s market heats up, global fund managers will be forced to invest in a market that they have underweighted for years.

- According to RTTNews, Japan’s Central Bank is expected to revise up its growth forecast for the year. Nikkei estimates that it could be revised to 2.5% or higher, up from 1.8% that it announced earlier.

- Finally, the Central Bank unveiled a $33.5 billion loan scheme to commercial banks, which should help businesses expand. The loans will be offered at 0.10% interest for one year.

It’s important to keep enthusiasm in check and make moves based on reality and what the markets are telling us right now. Most Japan-related ETFs are below their long-term trend lines, which for now would mean that there’s no uptrend in place. An easy way to watch them, though, is by becoming a Premium ETF Trends member and setting up alerts to be sent to your inbox. You’ll never again miss a key trading signal.

To find Japan ETFs, visit our ETF Analyzer and type “Japan” into the search box.

For more stories on Japan, visit our Japan category.

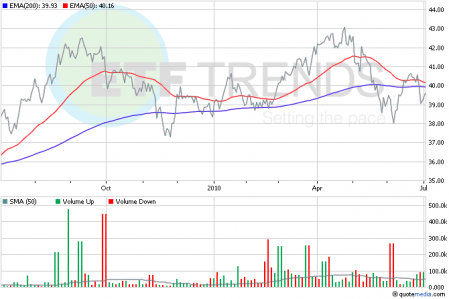

- iShares MSCI Japan Index (NYSEArca: EWJ), which invests in large-cap Japanese stocks.

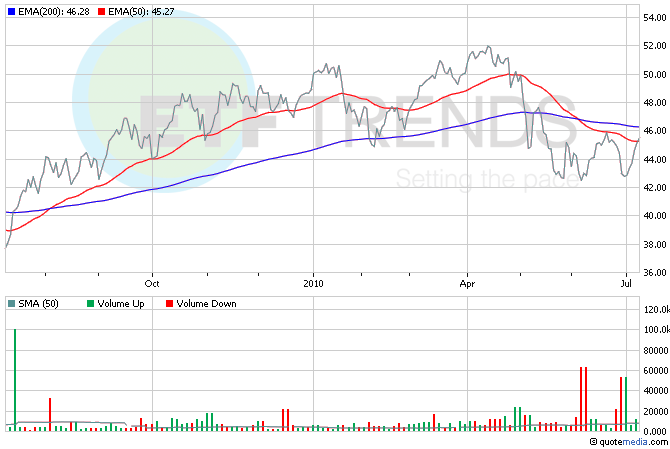

- Wisdom Tree Japan Small-Cap Dividend Fund (NYSEArca: DFJ), which captures the best of the Japanese small-cap sector.

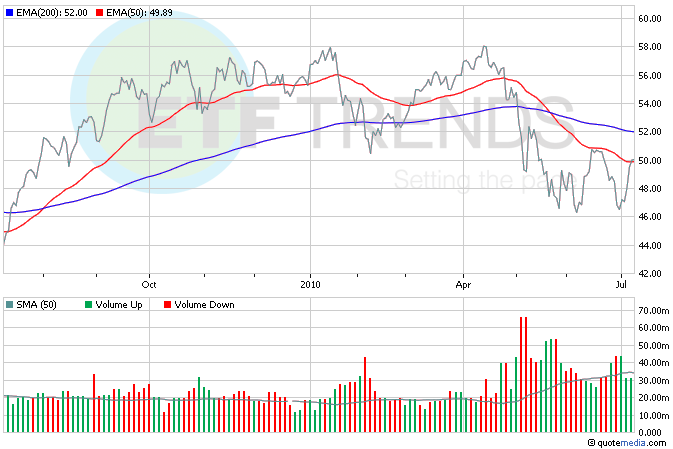

- iShares MSCI EAFE (NYSEArca: EFA): Japan is 22.1%

- WisdomTree Japan Equity Income Fund (NYSEArca: DNL)

Sumin Kim contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.