Finally, the housing market gets a break…of sorts. The news that home sales rose in June was enough to push exchange traded funds (ETFs) of various types higher in early trading.

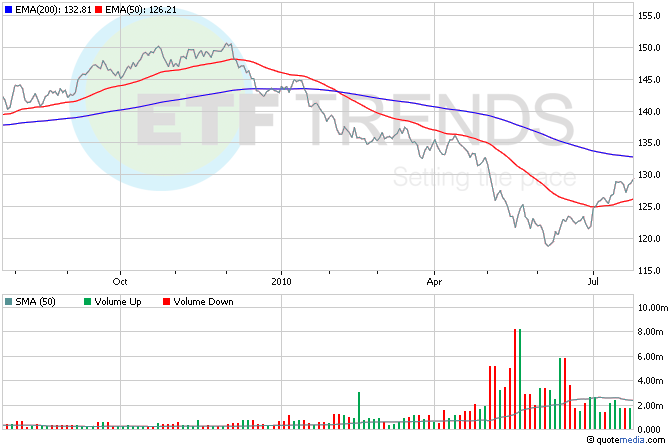

New home sales surged 24% last month from May. That’s the good news. The bad news is that it was still the second-weakest month since record-keeping began. Sales remain 72% below their peak. That said, there may still be opportunity to be had in homebuilder ETFs when the recovery begins. As the old adage goes: the most beaten-down sectors do the best in recoveries. SPDR S&P Homebuilders (NYSEArca: XHB) is up more than 2% this morning. [Homebuilder ETFs Lose Steam; REITs Gain It.]

ETFs that hold BP (NYSE: BP) stock could get a reprieve after CEO Tony Hayward gets the boot. He’s expected to be replaced with Managing Director Robert Dudley in October. SPDR S&P International Energy Sector (NYSEArca: IPW) has one of the heaviest weightings in BP found in ETFs. It’s up just under 1% early on. In the last three months, the fund is down 15.9%. [How Not to Get Burned By Commodity ETFs.]

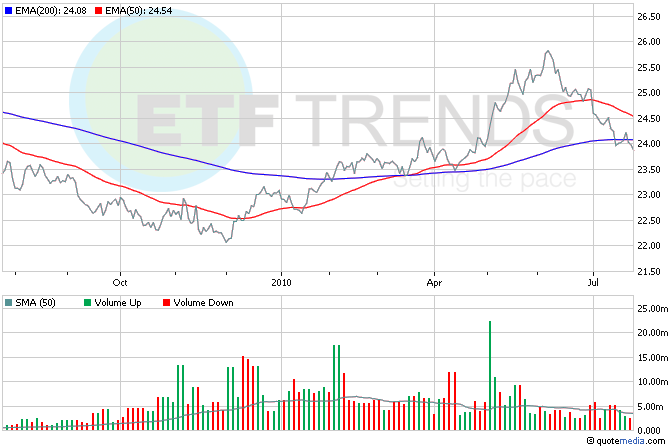

In the wake of the results of the European bank stress tests last Friday, euro ETFs are up slightly against the U.S. dollar. Some experts feel that good test results may have already been priced in, which meant the euro wouldn’t make wide swings in either direction. CurrencyShares Euro Trust (NYSEArca: FXE) is up 0.5% so far today; PowerShares DB U.S. Dollar Bullish (NYSEArca: UUP) is down the same amount. [ETFs for Changing Sentiment.]

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.