Maybe what the markets needed was a long weekend. In early trading today, stocks and exchange traded funds (ETFs) have been up as much as 150 points, led primarily by global funds.

While the U.S. markets were closed on Monday, global markets rose, contributing to the optimism at the open. The global rally was led primarily by Australia, which delivered an encouraging economic forecast while leaving interest rates unchanged for now. In a time of scarce positive economic reports, Australia’s confidence was greeted with veritable glee. [Switzerland ETFs: A Safe Haven in Europe?]

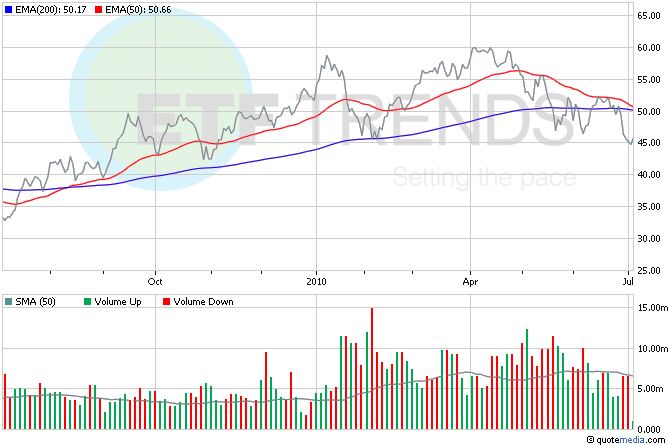

- iShares MSCI Australia (NYSEArca: EWA)

The service sector grew at a slower pace last month thanks to persistent worries about the national unemployment situation. While the index of non-manufacturing activity remains above 50, signaling growth, it declined to 53.8 from 55.4 in May. The index tracks sectors such as agriculture, mining, construction and retail trade. [Copper ETFs Spike, But Will It Stick?]

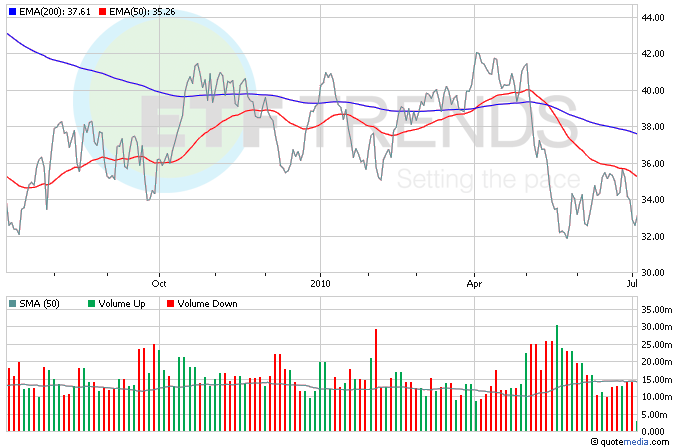

- SPDR S&P Metals and Mining ETF (NYSEArca: XME): XME lost 10.9% in June

Despite the slower growth in the service sector, any growth was enough to contribute to optimism that tends to push oil prices higher. Today is no exception, and crude is inching toward $74 a barrel. [Why Natural Gas ETFs Are BP Oil Spill Winners.]

- United States Oil Fund (NYSEArca: USO) is up about 1.7% so far this morning

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.