Encouraging signals about the economic recovery propelled exchange traded funds (ETFs) higher in early trading, including those focused on oil and the euro.

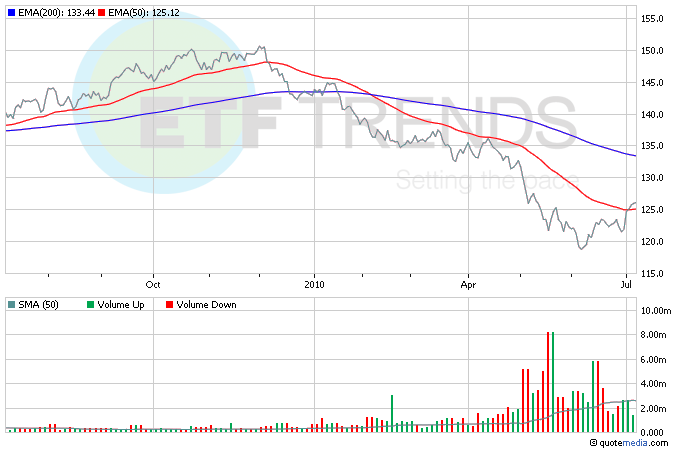

First-time jobless claims fell more than economists expected last week, to 454,000. No one can claim the job market is healthy, but it’s a step in the right direction, considering the lackluster June numbers that retailers posted. Consumers are clearly still hurting, which is in turn dragging down retail ETFs, which collectively lost around 11% last month. Sales did still increase last month, by 3%, but it was lackluster compared to what had been expected. [Craving Fast Food? Here Are 4 ETFs.]

So far this month, retail ETFs are faring somewhat better – many are up by at least 2%.

- Consumer Discretionary Select Sector SPDR (NYSEArca: XLY), up 2.5% so far this month

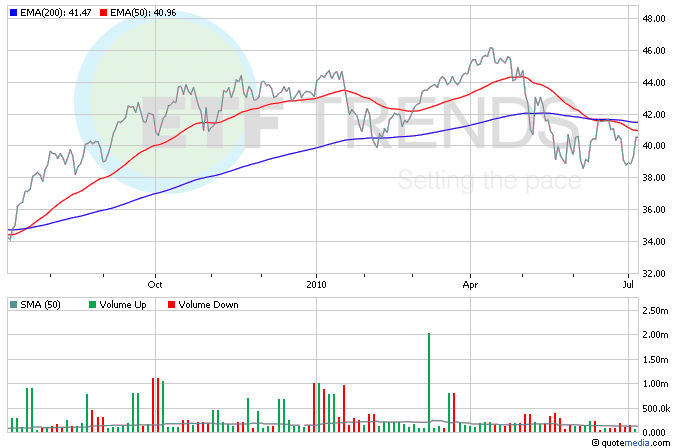

How things have changed. In recent days, the euro has surged to a two-month high – in the last week alone, euro ETFs are up by as much as 3.4%. Analysts owe it all to Wall Street, stating that the euro’s gains are primarily being driven by stronger markets this week. There may also be more confidence in the European banking system after new reforms were passed. [Switzerland ETFs: A Safe-Haven in Europe?]

- CurrencyShares Euro Trust (NYSEArca: FXE) is up slightly earlier today

The International Monetary Fund (IMF) has raised its forecast for global growth this year on the basis that the first half was better than expected for some economies. The world economy is now predicted to expand by 4.6% this year, with the United States and Canada seen as the developed economy leaders. [Canada ETF: Why Optimism Rules.]

- Vanguard Total World Stock Index (NYSEArca: VT) is up 4.8% in the last month

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.