Transportation exchange traded funds (ETFs) could be looking for a pop in the wake of earnings reports from the sector’s major players.

The transportation sector has always been a key indicator for market watchers who are watching cycles and signs for bear and bull markets. Don Dion for The Street reports that these ETFs are poised for a winning streak and that the recent lag in the fund has been on the decline in top holding FedEx (NYSE: FDX). [How the Shipping ETF Has Survived.]

But now the shipper may not be such a concern: this morning, it boosted its earnings outlook for the fiscal first quarter and the rest of the year. That’s because express and ground volumes have been higher than expected, according to The Wall Street Journal.

Three other bullish signals coming from the transportation sector:

- Strong earnings performance from firms such as Delta Airlines (NYSE: DAL), and US Airways (NYSE: LCC) in the near future may also be a strong driver of transportation funds. [Airline ETF Ready for Take-Off.]

- Matt Phillips for The Wall Street Journal reports that CSX (NYSE: CSX), the eastern U.S. rail giant, reported nice results last Monday after the close. CSX’s primary business is transporting freight like agricultural products, crushed stone, metal and coal. In fact, schlepping coal is the largest piece of CSX — around 30% of revenues. [6 ETFs for Rising Imports.]

- Memphis Business Journal reports that UPS (NYSE: UPS) posted a 90% jump in second-quarter profit and revenue has spiked in both U.S. and international package shipments. UPS’ earnings are viewed by some analysts as a leading indicator of the economy.

For more stories about transportation, visit our transportation category.

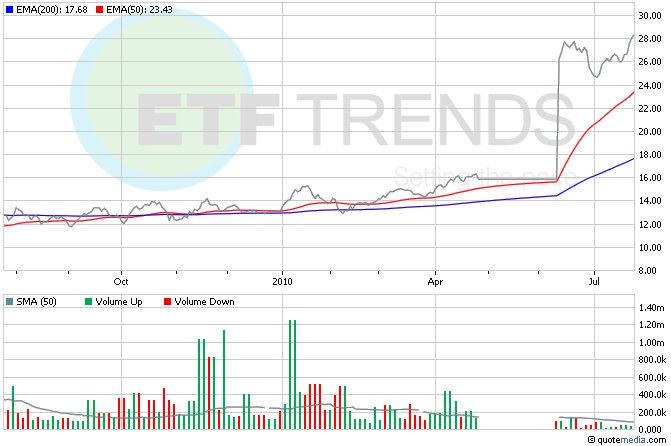

- iShares Dow Jones Transportation Average Index Fund (NYSEArca: IYT): Holds the stock of companies primarily in the United States. Industrials are 77% of the fund and consumer discretionary is 8%.

- Claymore Shipping ETF (NYSEArca: SEA): Holds the stock of shippers from around the world, though primarily in the United States at 54.9% of the fund. Hong Kong is 16.3%; Japan is 10%.

For full disclosure, Tom Lydon’s clients own IYT.

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.