Even as the real estate market continues to get beat up and property values sink, real estate investment trust exchange traded funds (ETFs) continue to pull their weight in the markets over the last year.

One way to explain this interesting phenomenon is that many REITs have boosted their balance sheets by raising money through secondary offerings and IPOs in 2009 and this year, says Trang Ho for Investor’s Business Daily.

REITs were also boosted with an upgrade from Fitch ratings from negative to stable. Industrial REITs were the only subsector to remain rated negative. [Housing Starts Lagging.]

REITs are different than the broad market in that REITs are designed to pass most of their income from renting their properties on to shareholders through dividends. The industry paid out about $13.5 billion in dividends last year, according to NAREIT (the National Association of Real Estate Investment Trusts). [How REITs Can Diversify.]

For more stories about REITs, visit our REITs category.

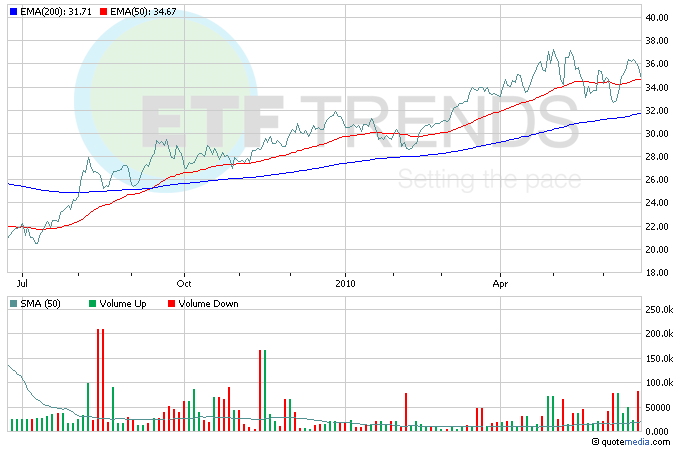

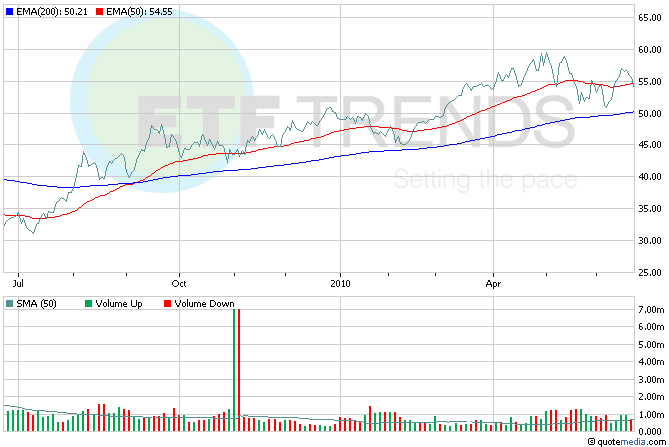

- iShares FTSE NAREIT Retail (NYSEAca: RTL)

- iShares FTSE NAREIT Residential (NYSEArca: REZ)

- SPDR Dow Jones REIT (NYSEArca: RWR)

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.