Homebuilders continue to be dealt blows to their confidence, and so far this morning, the markets and exchange traded funds (ETFs) seem to be sinking under the heavy weight of less than great numbers.

Housing starts declined to a five-month low in May, which should do little to restore the battered confidence of homebuilders these days. Yesterday, the homebuilder confidence survey declined 22% to its lowest level since March. The tax credit, which expired on April 30, is being blamed for the majority of the slowdown. [How REITs Can Diversify Your Portfolio.]

- iShares Dow Jones U.S. Home Construction (NYSEArca: ITB)

In far better news, industrial production shot up in May by 1.2%. This includes manufacturing activity at factories, mines and utilities. Production at utilities rose 4.8% as warm weather demanded more electricity usage; mining was the laggard, falling 0.2%. Consumer durable goods output was strong, rising 2.6%. [Why Copper ETFs Are Swooning.]

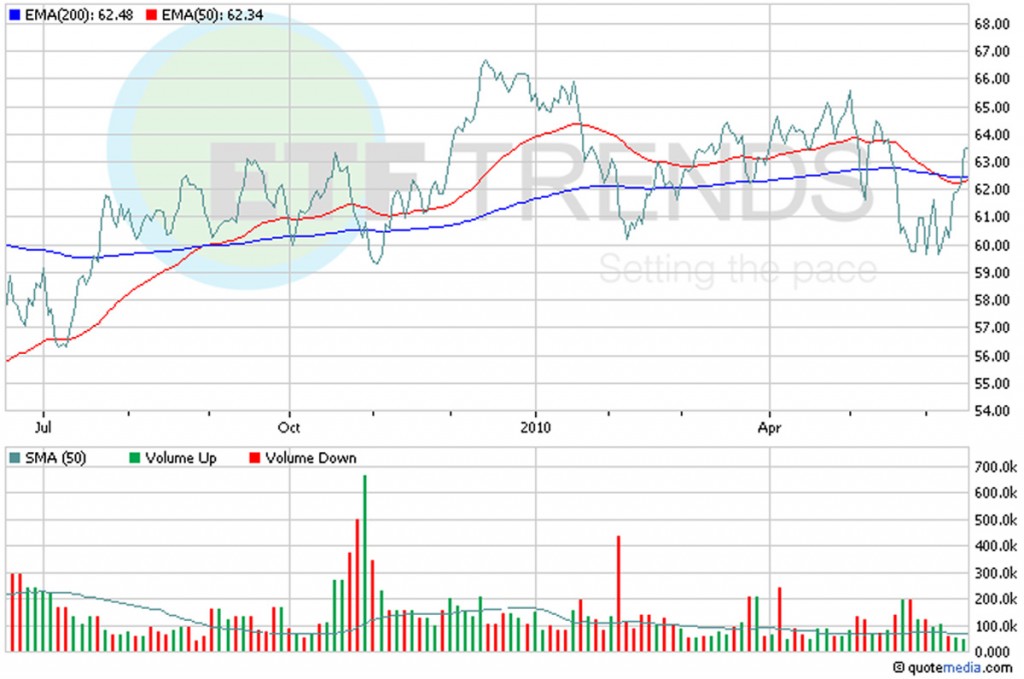

- Vanguard Utilities ETF (NYSEArca: VPU)

They’re baaaaack. Eurozone worries are once again alive and well this morning on talk of a bailout for Spain. The International Monetary Fund (IMF) is heading to Spain today amid rumors that a $309 billion credit line for the country is in the works. Spain denies the report, but it’s not helping Europe-focused ETFs any. [Spain ETF: Was Last Week’s Surge a Recovery Signal?]

- SPDR Dow Jones Euro STOXX 50 (NYSEArca: FEZ)

Read on for more stories about Europe.

Read on for more stories about Europe.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.