With our nation’s budget deficit reaching unsustainable levels, the defense sector is bracing for a cut to government spending. While budgetary cuts may not portend good news for exchange traded funds (ETFs), the anticipation may shorten the timeline of defense sector M&A activity and company restructuring, thereby giving investors opportunities to look for value.

According to Loren Thompson of Defense Professionals, M&A activity has already quickened as executives brace for budget cuts in 2012. These executives do not want to be caught in the middle of a devaluation of the defense sector.

However, executives are not the only ones aware of the pending budget cuts. Thompson says that since the revised budget is not yet apparent, “there will be a big gap in the near term between what sellers and buyers think defense properties are worth. Sellers will generally focus on recent track records…[while]buyers, on the other hand, will cite demand dampers in the near future.” [Why Aerospace Industry Is Feeling Bullish.]

It is unlikely that the big players like Lockheed (NYSE: LMT) or Boeing (NYSE: BA) will be allowed to consolidate, since the industry is already heavily concentrated. Thus, we should see second-tier companies dominate the field, as well as the biggest defense contractors putting individual units up for sale. For example, Lockheed Martin has put both its Enterprise Integration Group and Pacific Architects & Engineers units on the market.

iStockAnalyst thinks that although 2010 M&A volume may be lower than 2009’s volume, valuations may be higher. The article notes Cerebrus Capital Management’s announced acquisition of DynCorp in April for about $1 billion in cash, and that several defense companies including Argon ST, Carlyle’s Arinc Inc, DynCorp, Xe Services and two units at Lockheed Martin Corp have gone up for sale in the past few months. [2 ETFs to Play the U.S. Defense Needs.]

For more stories on the defense industry, visit our defense category.

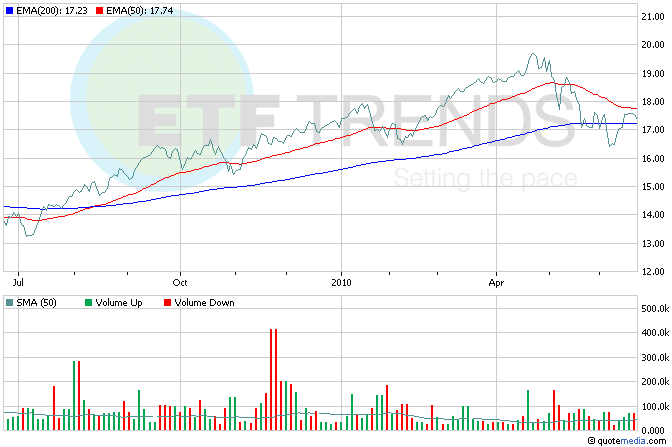

- iShares Dow Jones U.S. Aerospace & Defense Index Fund (NYSEArca: ITA)

- PowerShares Aerospace & Defense (NYSEArca: PPA)

Sumin Kim contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.