Is there are way to tell if the retail sector is ripe with opportunity right now and if the diversification benefits are better with a retail exchange traded fund (ETF)?

The theory of putting all of your eggs in one basket has cracked, and many investors now know that diversification is a key to a sturdy portfolio. Will Ashworth for Investopedia reports that the retail sector is offering an ideal entry point right now and ETFs can get you the exposure and diversification you need.

March’s numbers are in, and some retailers actually boosted their first-quarter performance and expect strong sales in April. What else is going on?

- The Spring weather has brought out the consumers again, and mall traffic is up a bit. People still need to clothes to wear and March has exceeded expectations.

- If what they say is true about the markets being six months ahead of the economy, retail stocks could be telling us that a slow rebound is afoot.

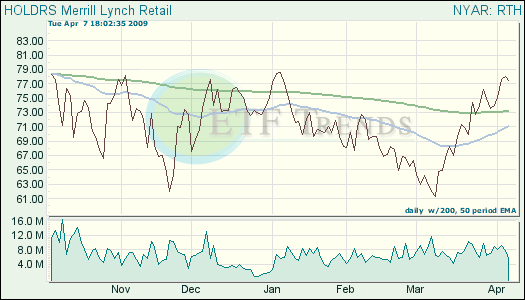

- Some retail funds are above their long-term trend lines.

- Retail HOLDRS (RTH) provides investors with one security invested in 18 different retail companies, all household names. In the past year, the ETF dropped about 18.5%, less than half the 38.9% decline of the S&P 500. The fund is up 4.8% year-to-date.

- SPDR S&P Retail (XRT) is broader, with 51components in the retail sector. The fund is up 26% year-to-date.

For full disclosure, some of Tom Lydon’s clients own shares of XRT.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.