The market may be sprouting the first signs of life, and the first to be rewarded may be the investors who kept their faith in the so-called green energy exchange traded funds (ETFs).

Many green-focused investors have taken the long-term view and have held on for what they believe in. Comparatively, most green investments lost 50-80% while the Dow Jones Industrial Average lost 40%. While this is at odds with our own strategy of using the 200-day moving average to capitalize on potential long-term uptrends, perhaps there might be opportunities in green investing soon.

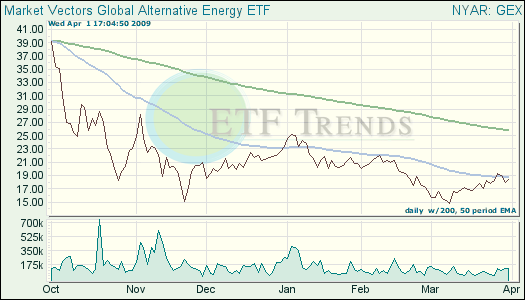

Clean-energy ETFs have been up sharply in the last month: Market Vectors Global Alternative Energy (GEX) has gained 20.5% in the last month and PowerShares Global Clean Energy (PBD) is up 25.7% in the last month. In comparison, the Dow is up 14.8% and the S&P 500 has gained 15.7% in the same time period.

Clean energy and efficiency make up about 14% of the American Recovery & Reinvestment Act of 2009, and many feel that the stimulus plan is the backbone to it all. One hindrance to potential growth in this sector is whether oil prices remain low: there seems to be a correlation between low oil prices and low interest in alternative energy.

A survey of institutional investors representing more than $1 trillion in assets found that 49% are “more likely” or “much more likely” to increase their exposure to clean energy now than they were a year ago. These institutional investors are going to bridge any gap in the long term for any financing issues, here in the United States and abroad.

- Market Vectors Global Alternative Energy (GEX): down 21% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.