Although there have been growing calls for the U.S. dollar to be replaced as the world’s reserve currency, there are still reasons to watch the movements of the greenback. Experts weighed in with their opinions.

The dollar has healed itself against the euro over the past six months, however, a major currency trader is not feeling bullish toward the U.S. dollar. George Soros is a major currency trader and has stated that the dollar remains vulnerable and could be replaced as the world’s reserve currency by a basket of denominations, including the euro, yen and British pound.

David Sherchuk for Forbes reports that the world’s financial system needs to be reformed so the dollar is subject to the same discipline imposed on other currencies. The United Nations believes that in order for the world’s economy to stabilize, the world should move to a collection of currency, rather than one.

Overall, here are some comments about the health of the U.S. dollar:

- George Soros says the dollar’s strength is a sign of the system’s sickness and the euro will actually remain viable.

- Greg Ghodsi, head of the 360 Wealth Management Division at Raymond James, says the decoupling theory is over. The world is one big marketplace, with the United States as the driving force. Ghodsi’s opinion is if our consumer spending habits drop permanently, the world will need someone to pick up the slack and start buying.

- John Osbon, head of Osbon Capital Management, says the twin deficits – soaring spending and free money – are bad for the dollar, but what currency isn’t facing the same situation or even worse? The future direction of currency is unknown.

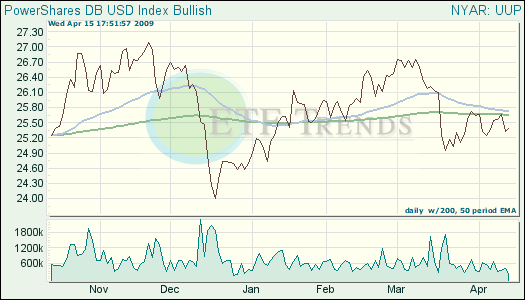

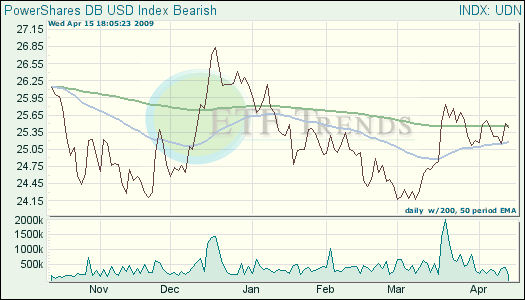

This is true, which is why we employ a trend-following strategy. Instead of trying to guess where the U.S. dollar is headed, especially at such a turbulent time, watch trend lines to see where the potential for a long-term uptrend exists.

- PowerShares DB U.S. Dollar Bullish (UUP): up 3% year-to-date

- PowerShares DB U.S. Dollar Bearish (UDN): down 3% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.