The bond market has been getting a lot of attention. Are you aware of the multiple ways you can use these exchange traded funds (ETFs) in your portfolio?

If you are searching for a bond-focused ETF to help round out your portfolio or keep assets in safety, the good news is there are about 58 different bond funds on the market. Jeffrey R. Kosnett for Kiplinger explains that this is more than enough to build any imaginable income portfolio, taxable or tax-exempt, using ETFs exclusively.

Overall, bond ETFs are pretty straightforward, easy to interpret and fill investment needs expediently. Among the ways they can be used:

- Treasury ETFs come in a range of maturities, and you can shift them up or down depending on where you think interest rates are headed. If you think they’re heading up soon, then long-term bonds would take a hit.

- With corporate bond ETFs, you can select from a few ETFs that target hunk bonds. There are also a number of ways to access investment-grade funds, as well.

- Worried about inflation? Try TIPS (Treasury inflation-protected securities). iShares Barclays TIPS Bond (TIP) and SPDR Barclays Capital TIPS (IPE) have an average maturity of nine years, and buys TIPS across the yield spectrum. The so-called Tips funds are are good preparer for inflation, which many say is looming ahead of us in the near future. Richard Lehman for Forbes says that while people are talking so much about deflation, what people should be wary of is inflation. While inflation can provide short-term relief, it’s harmful in the long run because it stifles real growth, hurts productivity and hurts savers.

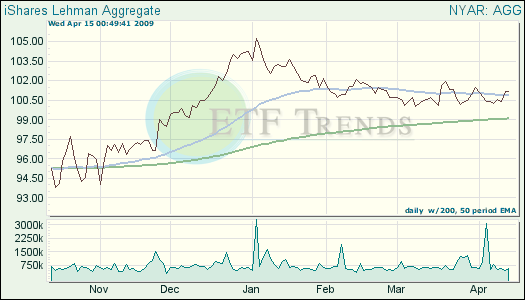

- If you just can’t decide, try a total bond market ETF. The Vanguard Total Bond Market Index (BND) and iShares Barclays Aggregate Bond Fund (AGG).

- Municipal bonds are proving to be a safe haven in these current market conditions. Under “normal” market conditions, the tax-free municipal bonds usually yield less than taxable bonds. Since the market is upside down right now, the non-taxable bond can actually offer better yields than most. Since states and towns can raise taxes to meet debts, muni bond defaults are extremely rare (but still possible). iShares S&P National Municipal Bond (MUB) and SPDR Barclays Capital Short-Term Muni Bond (SHM) are two ways to access this market.

Discuss fixed-income in our forums. How do you use these ETFs in your portfolio?

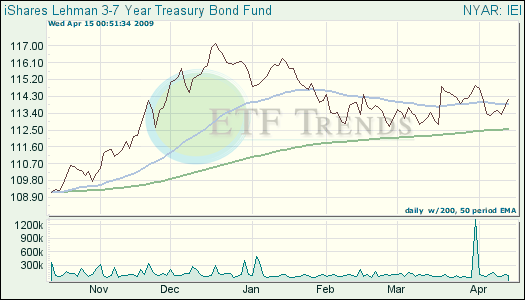

A few bond funds and their charts:

- iShares Barclays Aggregate Bond Fund (AGG) down 1.9% year-to-date; current yield 4.53%

- iShares Barclays 7-10 Year Treasury Fund (IEI): down 0.61% year-to-date; current yield 2.79%

- SPDR Barclays Capital Long Credit Bond ETF (LWC): up 1.2% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.