In addition to including equity exchange traded funds (ETFs) in one’s portfolio, adding Treasuries ETFs is another way to stay diversified.

Treasuries generally move in the opposite direction of stocks and are a good way to soften the blow of a massive stock market decline. In 2008, stocks of the largest U.S. companies tumbled 36% whereas the IFA 5-year government index, which tracks government bonds, gained 8.4%, states Matt Krantz of Usa Today.

When thinking about Treasuries, keep in mind that they aren’t foolproof either. If interest rates increase, the supply of Treasuries increases or if investors start to prefer stocks, then Treasuries will fall. Some even believe that a bubble in Treasuries has formed and may be the next to burst.

If you do want to add Treasuries to your portfolio, some ETFs available include:

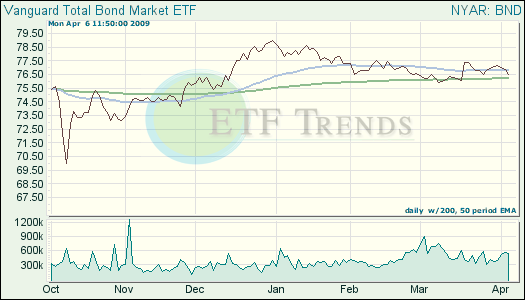

- Vanguard Total Bond Market ETF (BND), which is down 2.44% year to date and has a yield of 4.56%

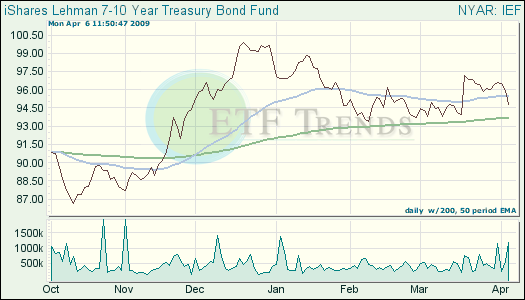

- iShares Lehman 7-10 Year Treasury Bond Fund ETF (IEF), which is down 3% year to date and has a yield of 3.74%

Kevin Grewal contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.