At the end of each trading day, the Dow Jones Industrial Average is what most people are talking about. But do you understand what moves the index and its exchange traded fund (ETF)?

Nearly every day, you’ll hear about the Dow being up or being down, but how many people know what the numbers actually mean?

The Dow is one of three major indexes in the United States. Combined, these indexes are all major indicators of the U.S. economy and its overall health. The other heavyweights are the S&P 500 and the NASDAQ Composite and along with the Dow, the group is referred to as the Security Market Indicator Series, explains Investopedia.

Of the three, the Dow is the most talked about and it is also the most easy to understand.

Here are some facts to help better understand the DJIA:

- History: Dow Jones & Co. was founded in 1882 by Charles Dow, Edward Jones and Charles Bergstresser. The focus was on growth stocks and transport companies. Then it became the transportation average, as nine railroad stocks, a steamship and communications company were all included. In 1896, the index diverged into two averages, creating the Dow Jones Transportation Average and the Dow Jones Industrials.

- Weighting Method: The Dow is price-weighted. A downside to this is that on top of having to deal with stock splits, it doesn’t reflect the fact that a $1 change for a $10 stock is much more significant percentage-wise than a $1 change in a $100 stock.

- Calculations: Originally, the benchmark that would project general market conditions and therefore help investors bewildered by fractional dollar changes. It was a revolutionary idea at the time, but its implementation was simple. The averages were, well, plain old averages. To calculate the first average, Dow added up the stock prices and divided by 11 – the number of stocks included in the index. Today, the DJIA is made up of 30 of the largest companies that lead the economy, chosen by the editors of The Wall Street Journal. Today, with stock splits, dividends dividing the Dow by 30 does not hold. The Dow Divisor was thus implemented, and it’s constantly being modified.

- Dollar Value: To figure out the dollar value of a DJIA number, Investopedia says to divide the stock’s price change by the current divisor. To find the current divisor, it can be located on the Dow Jones Indexes site.

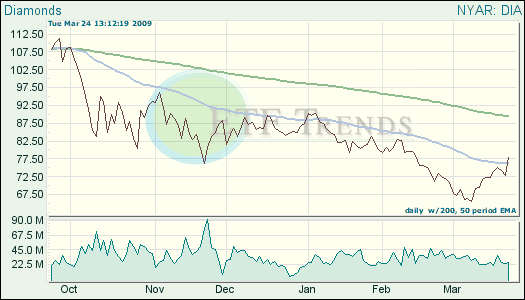

The DJIA is about 110 years old and it is the most watched and referred to index in the United States. The ETF below tracks the Dow and gives investors access to the top companies within:

- Diamonds Trust Series 1 (DIA): down 11.4% year-to-date; up 18.8% in the last two weeks

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.