While climate risk means new problems for vulnerable sectors, including electric power, high-tech, agriculture and beverages it also means opportunity for exchange traded fund (ETF) investors.

Global climate change is exacerbating water scarcity problems around the world, yet few businesses and investors are paying attention to this growing financial threat, according to a report issued by Ceres and the Pacific Institute.

Water is crucial for the global economy – driving every industry from agriculture to electric power to silicon chip manufacturing. Beverage, apparel and tourism also rely on supplies of clean, potable water to survive and grow.

Decreasing water availability is creating trends that cause a decrease in companies’ water allotments for manufacturing, shifts toward full-cost water pricing, more stringent water quality regulations and increased public scrutiny of corporate water practices.

The report concludes that climate change will exacerbate these growing water risks – especially as the world population grows by 50 million people every year. Already, China, India and the western United States are seeing growth limited by reduced water supplies from shrinking glaciers and melting snow caps that sustain key rivers. Meanwhile, agricultural and power plant production have been cut back because of more frequent and more intense heat waves and droughts in large parts of Australia, California and the Southeastern United States.

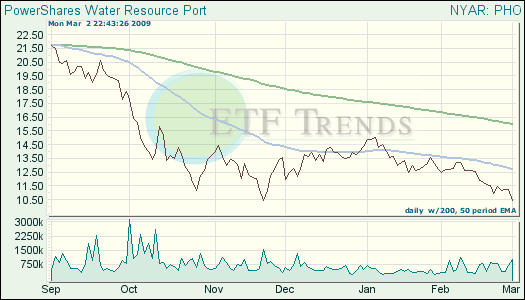

- PowerShares Water Resource Portfolio (PHO): down 27.3% year-to-date; down 4.6% for one week.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.