Existing home sales fell to levels not seen in 12 years, proof of the discontent that citizens are feeling toward the U.S. economy, markets and related investments and exchange traded funds (ETFs).

The National Association of Realtors said Wednesday that sales of existing homes fell 5.3%, flashing back to 1997. Potential buyers are waiting on the sidelines to see what President Barack Obama has planned for the housing industry and economy at large, reports Alan Zibel for the Associated Press.

The median sales price in January plunged to $170,300, down 14.8% from $199,800 a year earlier. An unclear picture of the job market, a seemingly bottomless housing market and unstable credit and banking system, along with lost retirements, are all factors contributing to the malaise.

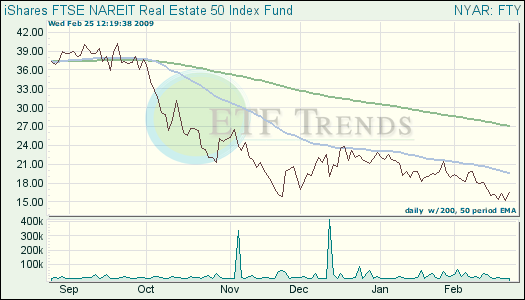

- iShares FTSE NAREIT Real Estate 50 (FTY): down 13.9% over three months; up 2.9% over one week

Thus far, banks are saying they have enough money, with enough capital to keep them afloat, however, this may not be the capital they need. The issue is coming to the fore as federal regulators start administering a tough new “stress test” to 20 large banks on Wednesday to determine how the banks would withstand a severe economic downturn, says Eric Dash on The New York Times.

Up until last Fall, investors focused upon Tier 1 capital, which consists of common stock, preferred stock and hybrid debt-equity instruments. Now, however, they are focusing on what is called tangible equity capital, which includes only common stock, saying it is a better way to measure the risk in bank shares.