If we didn’t have exchange traded funds (ETFs) and could bet big then an obvious winner would be to short the environment. Too malicious? Well, there are those who have pledged to fight the deteriorating environment, and the alternative energy industry and its ETFs are starting to pique our interest.

Global warming, melting ice caps, rising carbon dioxide levels are all happening and our leaders are taking note of it. President Barack Obama has already given his blessing to restrict greenhouse-gas emissions from cars, according to The Economist.

The European Union has also acknowledged the need for a global carbon-trading scheme and it has offered to cut its own emissions by 30% below 1990 levels, if such a scheme were arranged.

The use of clean-energy investments is seen as a form of economic stimulus that both the E.U. and President Obama are now utilizing. The E.U. has calculated that the world would need $224 billion a year to keep emissions at bay. A research group, New Energy Finance, estimates that the price tag should be at $515 billion a year.

A cost-benefit analysis model will need to be formed to provide us with an efficient way to invest in clean-tech. One way would be to use a carbon-trading scheme, or carbon tax, which would, hopefully, motivate entrepreneurs to find out the cheapest way to cut emissions and save money. Investors can use ETFs that focus on alternative energy.

- iPath Global Carbon ETN (GRN):down 27.4% in the last month

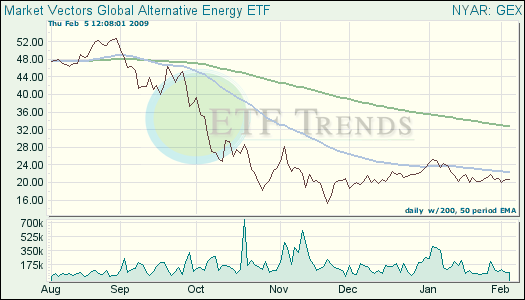

- Van Eck Global Alternative Energy Fund (GEX): down 18.3% in the last month

- PowerShares Cleantech Portfolio (PZD):down 14.9% in the last month

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.