- For a more diversified energy play, the PowerShares DB Energy Fund (DBE) replicates an index tracking the prices of two different grades of crude oil, heating oil, gasoline and natural gas. The high was reached on July 3, 2008; since then, DBE has lost 64.9%.

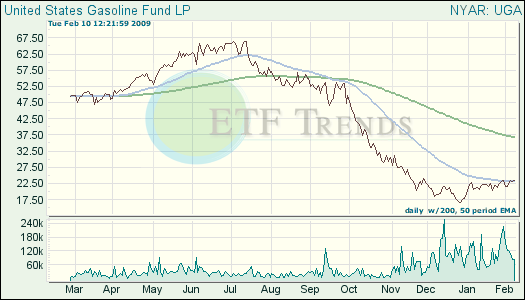

- United States Gasoline (UGA) tries to match the percentage increase in the unleaded gasoline futures that trade on the New York Mercantile Exchange. In concept, this fund increases in value by the same amount that gas rises in price at the pump. UGA reached a high on July 2, 2008, but has fallen 64.9% since then.

- iShares Dow Jones U.S. Energy Sector Index Fund (IYE) is as pure a play on energy as you can get with 10 top holdings including: Chevron (CVX), ConocoPhillips (COP), Exxon Mobil (XOM) and Transocean (RIG). IYE has fallen 43.3% since its May 20, 2008, high.

IYE made a distribution on Dec. 23 that isn’t reflected in the chart above.

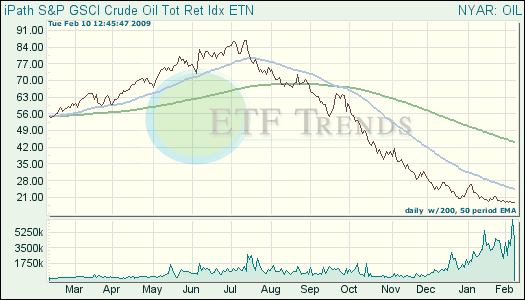

- iPath S&P GSCI Crude Oil Total Return Index ETN (OIL) is an unleveraged path to investment in Nymex West Texas intermediate crude oil futures. It takes a fixed-weight approach to determining asset allocation of its portfolio. OIL has lost 78.5% since its July 11, 2008, high.

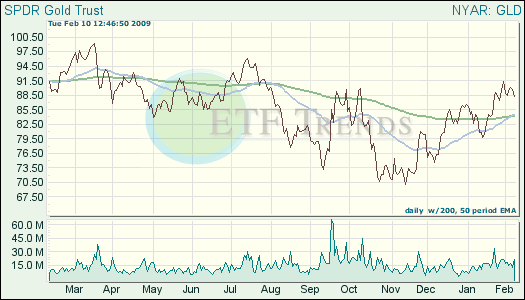

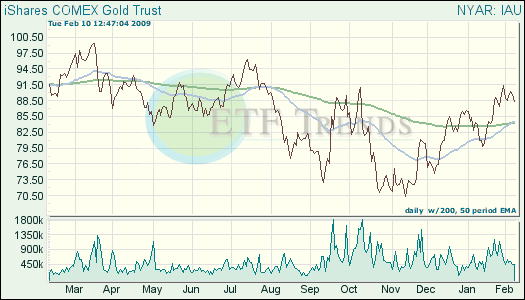

- The SPDR Gold Shares Fund (GLD) and iShares COMEX Gold Trust (IAU) hold gold bullion. GLD and IAU have both lost 10.9% and 11.1% respectively since their highs on March 17, 2008.

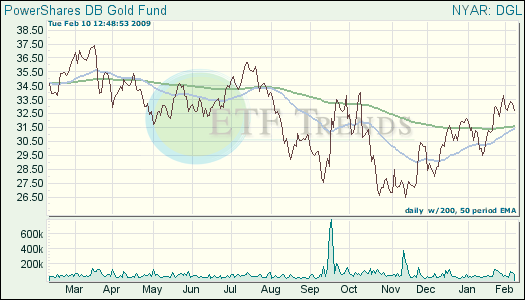

- The PowerShares DB Gold Fund (DGL) is based on the Deutsche Bank Liquid Commodity Index and is composed of futures contracts on gold and is intended to reflect the performance of the yellow metal. DGL has lost 12.6% since its March 17, 2008, high.

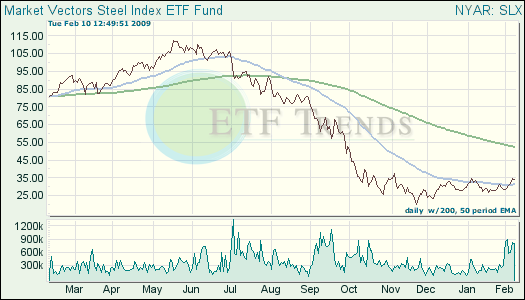

- Market Vectors Steel (SLX), which launched in October 2006, holds companies involved in the production of steel. Among the top holdings are Rio Tinto (RTP), Arcelor Mittal (MT.AS) and Companhia Vale ADS (RIO). SLX reached a high on May 16, 2008, but has since dropped 69.9%. On the other hand, there are high hopes for steel if President Barack Obama’s stimulus plan goes through. In the last month, it’s advanced 5.4% and moved above its short-term trend line.

SLX made a dividend on Dec. 26 that is not reflected in this chart.

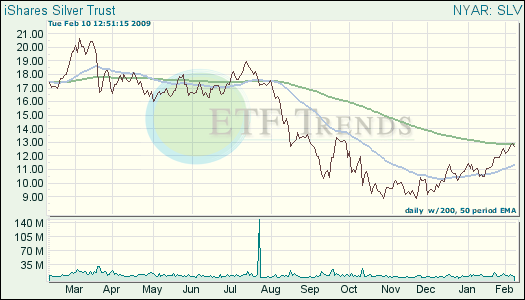

- The iShares Silver Trust (SLV) holds silver bullion. Silver has a wide range of industrial applications, making it particularly attractive when there’s a boom in construction activity, but sensitive to dowturns. SLV has lost 38.3% since its March 5, 2008, high.

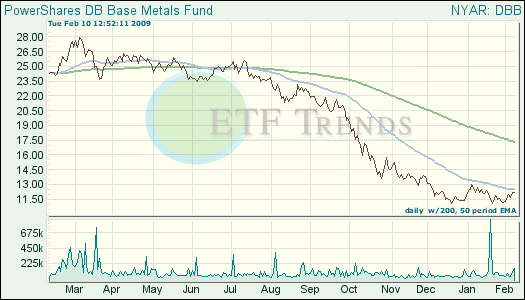

- PowerShares DB Base Metals (DBB) is based on an index composed of futures contracts on some of the most liquid and widely used base metals — aluminum, zinc and copper (grade A). DBB has lost 56.8% since its May 4 , 2007, high.

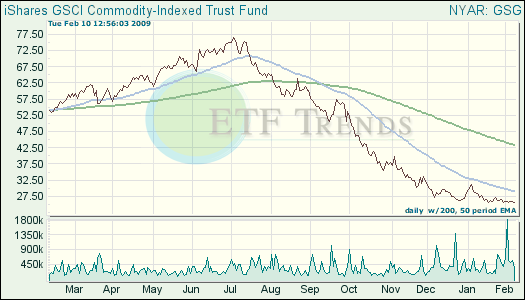

- iShares S&P GSCI Commodity Indexed Trust (GSG) tracks a broad index of 24 commodities weighted according to the proportion of the commodity flowing through the economy. Almost half of the index reflects crude oil, and the balance is split between other energy products such as natural gas as well as agricultural commodities, industrial and precious metals, and livestock. It hit a high on July 2, 2008, and has fallen 66.4% since then.

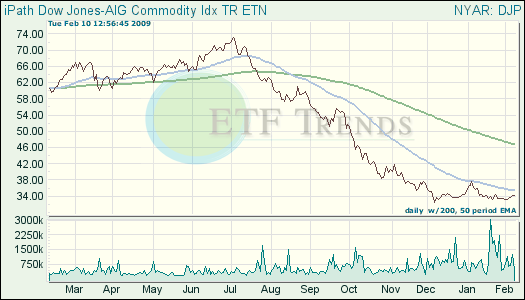

- An even more diversified commodity play is the iPath Dow Jones-AIG Commodity Index Fund ETN (DJP), which tracks an index that comprises 30% energy, 30% agricultural, 20% industrial metals, 10% livestock and 10% precious metals. DJP’s high was reached on July 2, 2008, but has lost 53.4% since then.

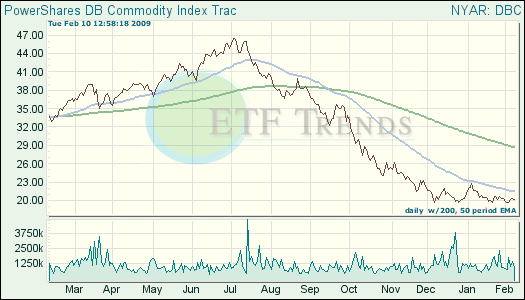

- PowerShares DB Commodity Index Tracking Fund (DBC) tracks the futures for a simplified index of just six commodities: corn, crude oil, gold, heating oil, aluminum and wheat. It hit a high on July 2, 2008, and has fallen 56.5%.

DJP made a distribution on Dec. 15 that is not reflected in this chart.

For full disclosure, some of Tom Lydon’s clients own shares of SLX, SLV and GLD and is a board member of U.S. Global Investors.