President Barack Obama just signed a plan to give troubled homeowners relief and keep Americans in their homes, however, exchange traded fund (ETF) investors shouldn’t be quick to make any assumptions that the plan is a cure-all.

Analysts’ reactions to this plan is is dicey at best, as the chances that the rescue will trigger a housing recovery that in turn will boost stocks are small. Many analysts predict that this bailout will have little or no effect on the markets at all, reports the Associated Press.

Here are five observations about the housing bailout plan:

- Who knows if it will work? The Obama administration pins its hopes for a housing turnaround on a plan that centers on making mortgages more affordable through lower interest rates and refinancing. Some analysts wonder why the plan doesn’t take a more direct approach toward principal reduction. The bigger question is whether homeowners can afford their reduced mortgage payments and still afford their homes.

- Banks get minimal help. A recovery has to be led by the banks, and one part of the plan calls for judges to be able to step in and force banks to lower payments. Analysts say that will weaken bank balance sheets by reducing the value of the mortgage-backed assets and thus put pressure on share prices. In the end, you are left with the same credit risks and lower-yielding assets.

- Psychological benefits are possible. Many analysts believe what this bill does more than anything is lift overall sentiment. While this plan is not likely to yield the turnaround Wall Street and others want to see, it can give way to a “cautious optimism.”

- Or, it could make things worse. The worst-case scenario is that the plan to prop up troubled mortgages will not address the need for housing prices to fall to sustainable levels, which was the original intent. By putting off a foreclosure, it may only be delaying the inevitable and using more valuable taxpayers dollars in the meantime.

- Investors should remain cautious. The scope of the homeowner relief plan is marginal at best. The majority of advisors do not use this bailout as a springboard for many to jump back into the market. At best, moderate spikes in consumer spending could abound, as well as ETF investors playing market movements to make some extra cash.

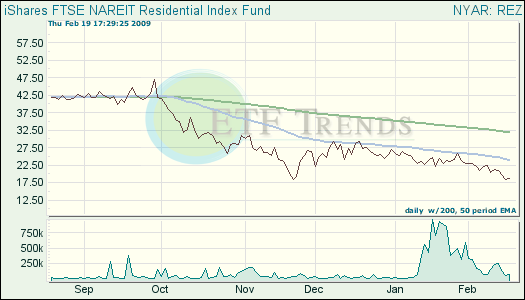

- iShares FTSE NAREIT Residential (REZ): down 14.7% over three months; down 11.6% over one week

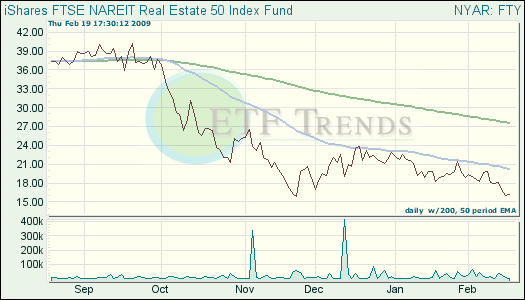

- iShares FTSE NAREIT Real Estate 50 (FTY): down 8.5% over three months; down 10.3% over one week

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.