World growth forecasts have been adjusted to allow for the slowdown in all markets, and India’s markets and exchange traded funds (ETFs) are no exception.

Slowing Growth. The International Monetary Fund has lowered India’s growth to 5%, and the growth rate should raise in 2010 to 6.5%, reports Arun Kumar for Hindustan Times.

Rising Inflation. India’s key wholesale inflation rate slowed to 5.6% this month as lower commodity prices and weak consumer demand is weighing on many economies, reports Cherion Thomas for Bloomberg. Indian Commerce Minister Kamal Nath has warned of protectionism, which he views as a threat to the world economy. The new U.S. administration is expected to participate in the Doha Round of global trade talks in a positive manner, reports Yan on China View.

However, there are some reasons India should not be counted out:

- Some analysts view India’s growth prospects as higher, around 6%, due to their stronger economic fundamentals, a push for smarter policies and interest rate cuts that could lead to more demand for loans and credit.

- India’s growth is driven internally – only 17% to 20% of the economy is driven by exports.

- There are new calls being made for more corporate transparency, which could foster new levels of trust.

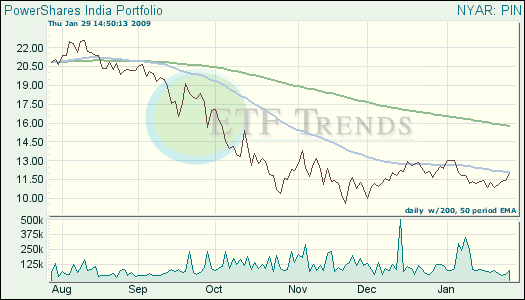

- PowerShares India (PIN): up 3.6% over past three months

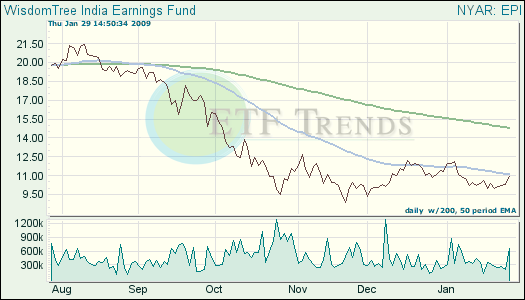

- WisdomTree India Earnigs (EPI): up 2% over past three months

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.