The countries within the European Union are all contemplating economic hardships, as the citizens learned to live beyond their means, giving way to possible bankruptcy and losing gains within markets and exchange traded funds (ETFs).

A Plan That Isn’t Working. The inhabitants of the 16-country euro currency zone have experienced living beyond their means and taking on massive debt through consumption, only to find themselves in the throes of abandoning the currency altogether or going bankrupt. Landon Thomas Jr. for The New York Times reports that the adoption of the euro about 10 years ago by countries such as Greece, Italy, France and Spain was meant to unify Europe economically and politically.

Adding to Debt. The new idea is that the glory of the euro has glossed over the serious economic problems that plague these countries, and possibly exacerbated them by increasing debt. The currency had once been a possible way to rival the United States, while the poorer countries were prided on their euro zone membership, as proof they had their finances and debt in order.

Smaller Countries Have to Fight. Some of the stronger countries such as France, Germany and the Scandinavian members have been able to shore up their economies and create billion-dollar stimulus plans while protecting their banks; the smaller countries, such as Greece, Ireland, Italy and Spain, have been left out in the cold, having to fend for themselves in the global uncertainty. It’s turned out that membership hasn’t been a cure-all of social and economic issues.

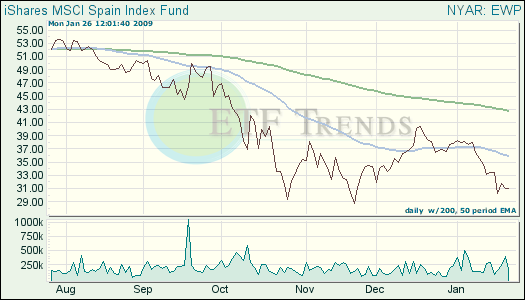

- iShares MSCI Spain Index (EWP): down 18.2% year-to-date

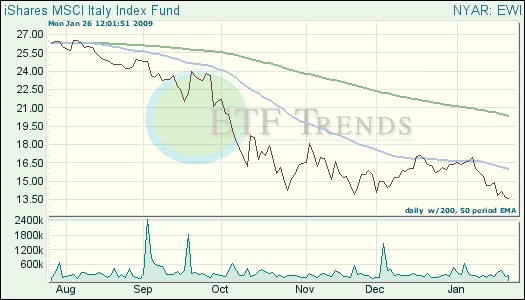

- iShares MSCI Italy Index (EWI): down 17% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.