Long commodity exchange traded funds (ETFs) have experienced an influx of billion of dollars, which is an exact opposite of the selloff seen at the end of 2008.

What Does It Mean? Investors are showing confidence in energy prices as most of the inflow has been geared toward long focused ETFs, or betting on the rising price of the commodity. This signals that investors are feeling optimistic about the direction of these commodities.

This new trend in buying could add some much-needed liquidity to the markets and also demonstrate that portfolio rebalancing is popular right now, reports Carolyn Cui for The Wall Street Journal.

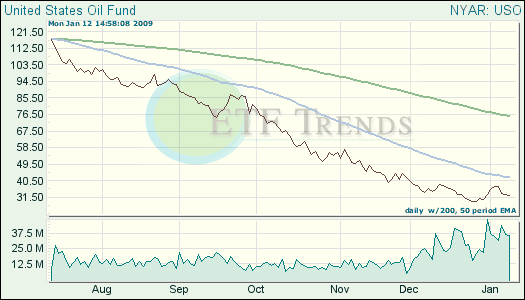

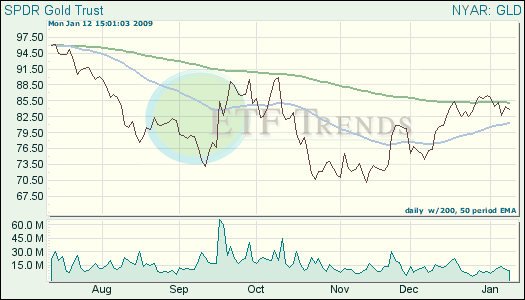

Who’s Getting the Money? Among the commodities, oil and gold are capturing the most interest, and opportunity has been renewed for investors seeking exposure to raw materials. Many seem undeterred over questions of whether the rally will stick in the long run. United States Oil (USO), the largest oil ETF, gained $2.1 billion in net assets and SPDR Gold Shares (GLD), the largest gold fund saw $603 million flow into it last month, according to The National Stock Exchange.

- United States Oil (USO): down 6% over one month

- SPDR Gold Shares (GLD): up 9.9% over one month

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.