For those investors who have had it with the actively managed mutual fund, why not consider exchange traded funds (ETFs) on your next introduction into the stock market when the rebound begins?

An ETF is simply a basket of stocks, like a mutual fund, that trades throughout the day on an exchange, like a single stock. ETFs trade at any time of the day and tout flexibility and transparency. Since ETFs can be sold short or traded on margin, their popularity has increased and may eventually surpass that of a mutual fund, reports Amanda Kish for The Motley Fool.

These are some of the most popular, and diverse ETFs around and they track broad indexes which tend to offer the best diversification:

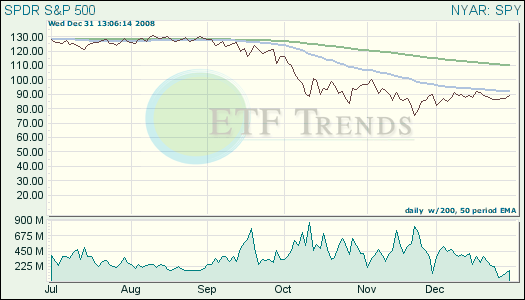

- SPDRs (SPY): down 39.4% year-to-date; tracks the S&P 500 index

- Diamonds (DIA): down 34.2% year-to-date; represents the Diamonds Trust Series, which tracks the Dow Jones Industrials.

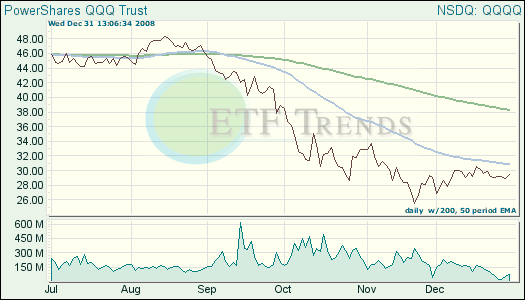

- Cubes (QQQQ): down 43% year-to-date; A PowerShares listing that tracks the NASDAQ 100 Index, which contains the 100 largest non-financial companies listed on NASDAQ.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.