There is little sign of a sudden turnaround in food or energy prices, however, commodities could get a lift from the coming infrastructure spending with Obama’s new plan. Monsanto, the world’s largest seed maker, has reported its fiscal first-quarter profit more than doubled on higher sales to Latin America, and raised its expectations for the year, reports Marley Seaman for the Associated Press.

Latin American sales make up the bulk of Monsanto’s first-quarter revenue. Most of the company’s revenue come from its U.S. business, where sales pick up in the second and third quarters.

- Energy Select Sector SPDR (XLE): up 16% in 2 weeks; 5.4% above 50-day

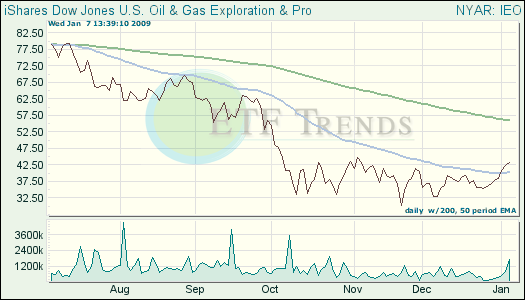

- iShares Dow Jones US Oil And Gas Exploration Index (IEO): up 22% in 2 weeks; 8.2% above 50-day

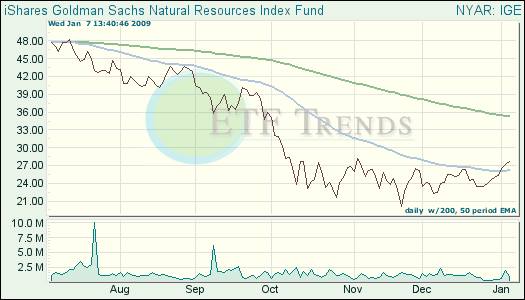

- iShares S&P North American Natural Resources (IGE): up 18.2% in 2 weeks, 6.3% above 50-day

Right now, commodities appear to be on an uptrend, and you can’t fight the trend. It’s why we use the trend-following strategy we do – so we can be in when the trend is up and out when it’s down.